Cryptocurrency News

Latest updates and analysis from the crypto world

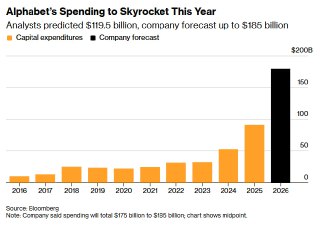

Alphabet Plans Record AI Spending, Forecasts Up to $185B in 2026

Alphabet plans record AI capex in 2026, forecasting $175–$185B vs. $119.5B analyst expectations, signaling an aggressive data center and AI infrastructure push.

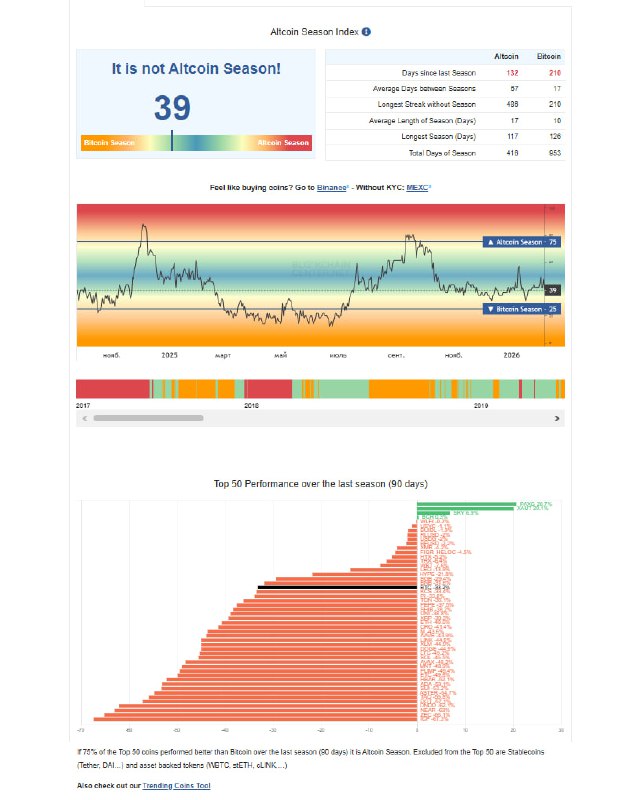

Altcoin Season Index at 39: Bitcoin Outpaces Most Altcoins Over 90 Days

Altcoin Season Index is at 39, signaling it’s not altcoin season. Only 17 of the top 50 coins outperformed Bitcoin in the last 90 days as BTC dominance holds.

Bitcoin Falls Below $71K as $855M in Longs Are Liquidated; On‑Chain Stress Mounts

Bitcoin fell below $71K, briefly testing $70K, as $855M in positions were liquidated. On-chain metrics show forced selling; crypto market cap is down ~20% YTD.

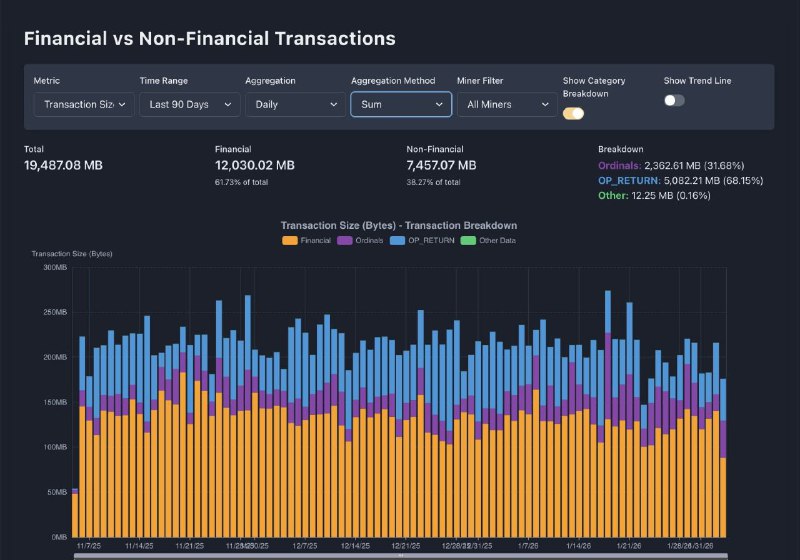

Bitcoin blockchain added 19.5 GB in 90 days; 7.5 GB was non‑financial data

Over the past 90 days, Bitcoin’s blockchain grew by ~19.5 GB, with ~7.5 GB from non‑financial activity like OP_RETURN and Ordinals, intensifying blockspace debates.

BlackRock’s IBIT Remains Fastest-Growing ETF Despite AUM Falling to $60B

BlackRock’s IBIT AUM fell from $100B to $60B but remains the fastest-growing ETF among funds under 500 days, per Eric Balchunas. A landmark for Bitcoin ETFs.

Ethereum whales distribute as transfers hit 1.17M; $167.8M withdrawn from Binance

Ethereum whales are distributing as transfer count hits 1.17M (14D MA). Stable exchange reserves, $167.79M Binance withdrawal, and large block trades signal volatility.

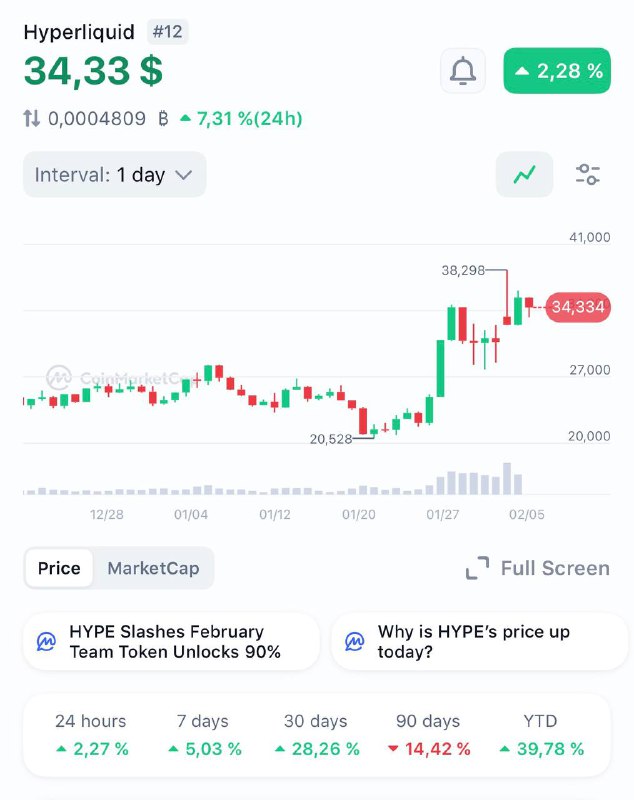

Hyperliquid Tops $1B in Fees as HYPE Token Rises 28% in a Month

Hyperliquid surpasses $1B in cumulative fees as HYPE gains 28% over the month, trading near $34.33. Data shows fees approaching $1.2B by early 2026.

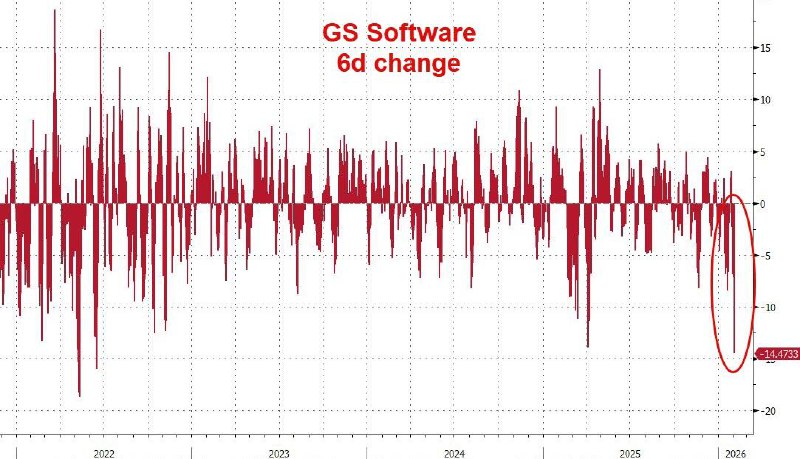

Software Sector Sheds $2 Trillion From Peak as Sell-Off Deepens

The software sector has lost about $2T—roughly 30% from its peak—as selling pressure persists. Oversold conditions and a −14.47% six-day move signal deepening stress.

U.S. Auto Stocks Split: Tesla Soars as Rivian, Lucid Slide; GM, Ford Hold Steady

A $10,000 investment in U.S. auto stocks saw stark splits: Tesla surged, GM and Ford held steady, while Rivian and Lucid tumbled—highlighting fundamentals over hype.