Lead

Zcash (ZEC) surged past $500, hitting its highest level since 2018 amid a burst of speculative interest. Intraday prints near $522 on major exchanges underscored strong momentum, while notable market dislocations and large leveraged positions spotlighted rising volatility. Former BitMEX CEO Arthur Hayes said he is long ZEC and set a $1,000 price target.

Key Developments

- Price milestone: ZEC crossed $500 and traded around $522 against USDT on Binance during the latest session, marking the token’s strongest level in nearly seven years.

- Seven-year high: The move places Zcash at its highest price territory since 2018, reviving interest in legacy privacy narratives.

- Trader sentiment: Arthur Hayes indicated he is long ZEC with a $1,000 target, amplifying bullish sentiment around the asset.

Market Anomalies

- Bitfinex discount: In USD trading, ZEC on Bitfinex was observed about 22% below broader market pricing, suggesting fragmented liquidity or temporary order book imbalances. Such gaps can reflect venue-specific liquidity constraints during fast-moving markets.

- Leverage stress on derivatives: On the Hyperliquid perpetuals venue, a single ZEC contract showed an unrealized loss of about $10.8 million, highlighting the scale of directional bets and the risk of liquidations or short squeezes in thin conditions.

Trading Activity and Momentum

- On Binance’s ZEC/USDT daily chart, ZEC printed an intraday price near $522, with strong volume accompanying the breakout.

- Leaderboards over the same window placed ZEC among top performers, alongside ICP and Quant, with one snapshot listing:

- ICP: $5.97 (+20.23%)

- Quant: $86.74 (+18.41%)

- Zcash: $515 (+18.32%)

Context and Implications

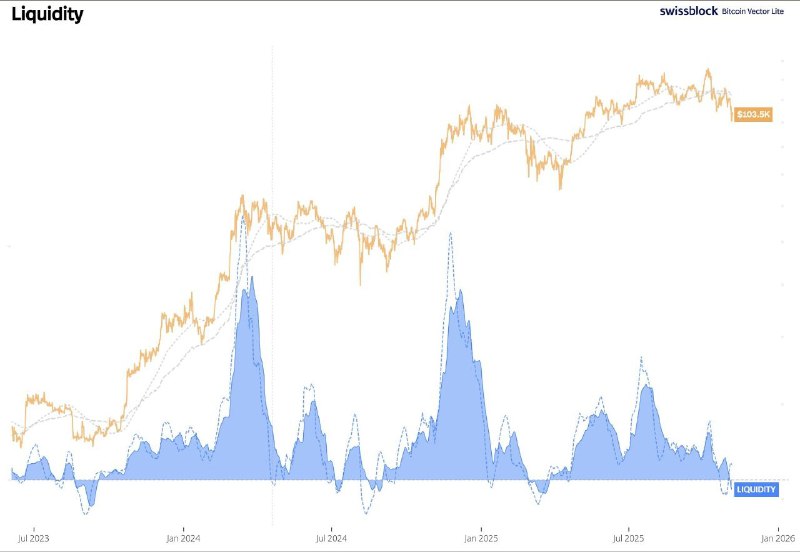

Zcash’s rapid rise comes as broader crypto liquidity shows signs of improvement and traders rotate into higher-beta narratives. The outsized Bitfinex discount and visible large losses on derivatives platforms underscore how quickly conditions can diverge across venues when momentum accelerates.

For investors, the breakout above $500 is a technically significant level that may attract trend-following flows. However, the presence of sharp venue-specific mispricings and large leveraged positions suggests elevated volatility risk. Participants should monitor spreads across major exchanges and the stability of derivatives funding as ZEC approaches potential resistance zones.

About Zcash

Zcash is a privacy-focused cryptocurrency enabling optional shielded transactions using zero-knowledge proofs. More information is available on the Zcash website.

Conclusion

With ZEC back above $500 for the first time since 2018 and some traders eyeing $1,000, Zcash has reentered the spotlight. Continued liquidity normalization and the behavior of leveraged positions will likely determine whether the rally extends or cools amid elevated volatility.