Whale Deposits $10.54M in UNI to Binance

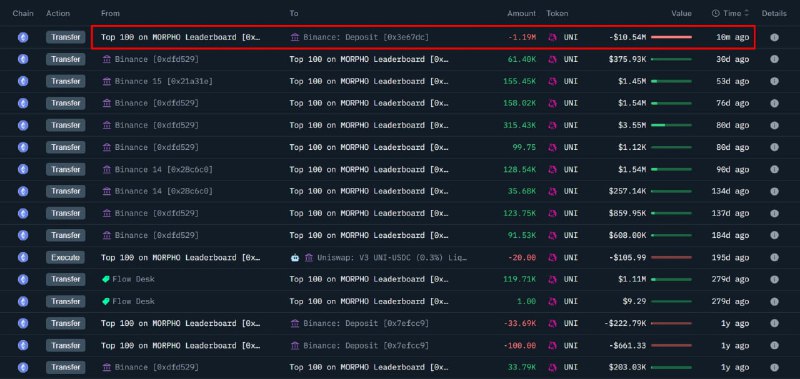

A large holder moved 1.19 million UNI (approximately $10.54 million) to Binance, locking in an estimated $914,000 realized loss. On-chain records show the address had accumulated the tokens for a total outlay of $11.45 million between February 5, 2025 and October 12, 2025, sourcing UNI from Binance and market-making firm Flowdesk.

Key Developments

- Deposit size: 1.19 million UNI (~$10.54M)

- Realized result: ~$914K loss relative to the holder’s acquisition cost

- Accumulation window: Feb 5–Oct 12, 2025

- Sources of accumulation: Binance and Flowdesk

- Address involved: 0x4c6452F18D5967F1f7e9884BC5cDFC60452E015A

Market Context

UNI trading activity around the time of the transfer indicated mild pressure, with the token showing a decline of roughly 1.8% on intraday metrics. While exchange deposits by large holders are often interpreted as a potential precursor to selling, they can also precede hedging, market-making, or cross-exchange liquidity operations, especially when entities have relationships with professional counterparties like Flowdesk.

Why It Matters

- Potential sell pressure: A sizable deposit to a centralized exchange can signal a willingness to sell or rebalance positions.

- Loss-taking behavior: Realizing a loss of nearly $1 million may reflect risk management or rotation into other assets.

- Transparency: The publicly visible address enables continued monitoring of subsequent transfers and executions.

On-Chain Details to Watch

- Subsequent movements from the address, especially transfers from Binance that could indicate withdrawals instead of sales.

- Changes in UNI order book depth and funding rates that may reflect increased directional activity.

- Any new inflows from Flowdesk or other market makers that could signal liquidity provisioning rather than outright distribution.

Conclusion

The transfer of 1.19M UNI to Binance by address 0x4c64…015A marks a notable on-chain event, pairing a large exchange deposit with a $914K realized loss. Traders will be watching for follow-through selling or hedging flows and their impact on Uniswap’s UNI price dynamics in the short term.