Lead

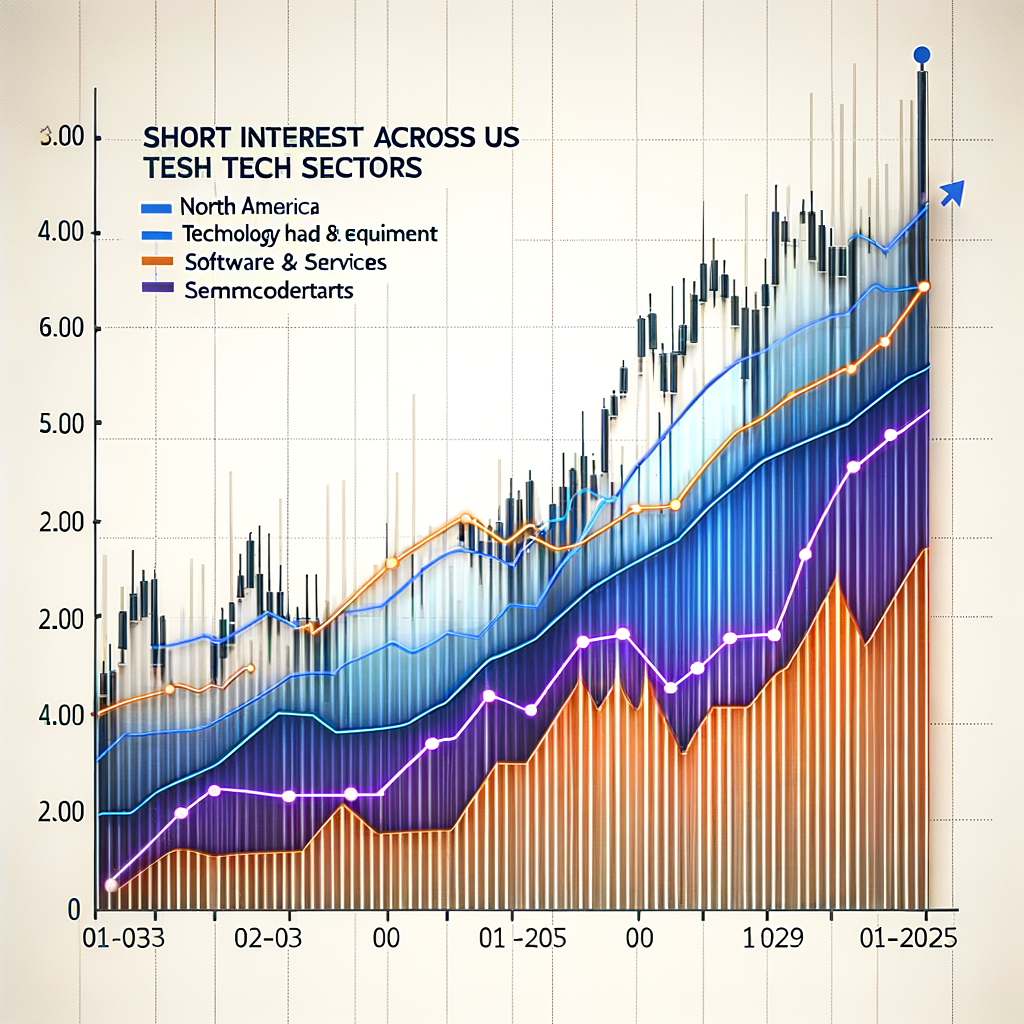

Short positions in US semiconductor stocks have climbed to their highest level this year, signaling growing caution around the sector. Fresh short-interest data across major tech industries from mid-January to mid-July 2025 also shows diverging trends, with Technology Hardware & Equipment peaking above 0.8% in mid-February while Software & Services remained comparatively stable.

Key Developments

- Timeframe observed: January 13, 2025 – July 11, 2025

- Sectors tracked: North America Semiconductors & Semiconductor Equipment; Software & Services; Technology Hardware & Equipment

- Semiconductors: Short interest rose through the period, reaching its highest level in 2025 by early July

- Technology Hardware & Equipment: Short interest spiked above 0.8% around mid-February 2025

- Software & Services: Held near 0.4%, with only modest upticks

Sector Breakdown

The data highlights a rotation in bearish positioning across US tech:

- Semiconductors & Semiconductor Equipment: Starting near roughly 0.2%, short interest edged higher into July, underscoring a cautious stance toward chipmakers despite ongoing AI-related demand themes.

- Technology Hardware & Equipment: Exhibited the sharpest move, with a pronounced peak above 0.8% in mid-February, suggesting a period of intensified hedging or directional bets against hardware names.

- Software & Services: Showed relative stability around the 0.4% mark, indicating less aggressive bearish positioning compared to hardware and chips.

Market Context

Rising short interest in semiconductors often reflects investor vigilance around earnings volatility, inventory normalization, and cyclical demand shifts. While not a direct signal for cryptocurrencies, heightened risk aversion in high-beta tech segments can influence broader risk appetite, occasionally spilling over into digital assets and crypto-related equities.

Looking Ahead

Traders will watch upcoming earnings and macro data for confirmation on whether bearish positioning in semiconductors persists or moderates. Any shift in sector outlooks—particularly for AI supply chains and capital expenditure cycles—could recalibrate short interest across US tech and potentially sway sentiment in adjacent risk markets.