Key Takeaway

US non‑farm employment declined by 9,000 in October, with government job losses more than offsetting a small increase in private‑sector hiring, according to alternative labor‑market data from Revelio Labs. The data points to uneven momentum across sectors as the year progresses.

Key Developments

- Headline change: Non‑farm employment fell by 9,000 (m/m) in October.

- Sector split: Decreases in the government sector outweighed modest gains in the private sector.

- Methodology note: The figures reflect month‑over‑month changes derived from Revelio Labs’ employment tracking.

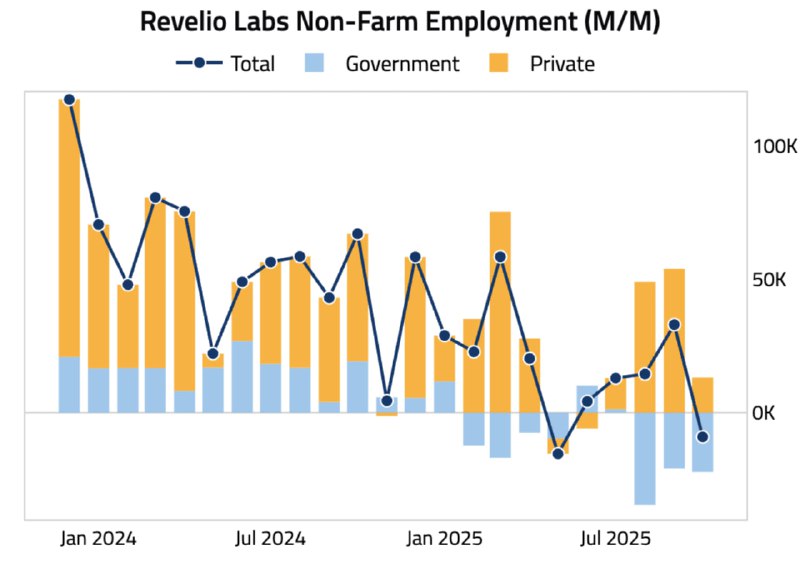

Revelio Labs’ visualization titled “Revelio Labs Non‑Farm Employment (M/M)” breaks out the trend across Total (line), Government (light blue bars), and Private (orange bars), with an axis scale up to 100,000. The chart history shows:

- Total employment fluctuating through 2024 and early 2025, peaking around mid‑2024 and dipping in early 2025.

- Private‑sector employment exhibiting noticeable volatility with intermittent spikes and pullbacks.

- Government employment remaining relatively stable, with a subtle upward tilt observed in early 2025.

Revelio Labs provides alternative labor indicators that can complement official statistics by offering timely, high‑frequency insights into hiring and workforce changes.

Market Context and Implications

Softening employment momentum—particularly driven by government payroll reductions—may influence expectations around US growth and interest rates. For risk assets, including Bitcoin and broader crypto markets, signs of a cooling labor market can sometimes translate into shifting views on Federal Reserve policy, US dollar strength, and overall liquidity conditions.

- If labor data continues to cool, markets may reassess the interest‑rate path, potentially affecting bond yields and risk appetite.

- Persistent divergence between public and private payroll dynamics could signal sector‑specific budget constraints versus ongoing, if uneven, private hiring.

Looking Ahead

Investors will watch upcoming labor releases and revisions to gauge whether October’s decline marks a temporary pause or the start of a broader deceleration. Cross‑checks with official monthly employment reports and wage data will be key to confirming the trend and assessing potential macro and crypto‑market impacts.