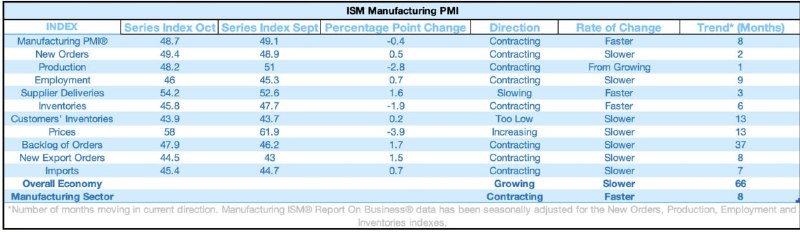

US manufacturing activity weakened in October as the Institute for Supply Management’s (ISM) Manufacturing PMI fell to 48.7 from 49.1 in September, staying below the 50-point threshold that separates expansion from contraction. It marked the eighth consecutive month of contraction, underscoring ongoing softness in the industrial sector.

Only one of the five key subindexes—Supplier Deliveries—registered growth in October. That was down from September, when two subindexes showed expansion. The persistent weakness highlights uneven demand conditions across factories, with new orders, production, employment, and inventories collectively failing to lift the headline index back into expansion territory.

A sub-50 PMI typically signals shrinking activity, a datapoint closely watched by markets for clues about growth momentum and potential policy implications. Prolonged softness in manufacturing can influence expectations around interest rates, Treasury yields, and the US dollar—factors that often spill over into risk assets including equities, Bitcoin, and broader crypto markets.

Investors will be monitoring upcoming economic releases and corporate guidance to gauge whether manufacturing headwinds persist into year-end and how they may shape overall risk sentiment.