Lead

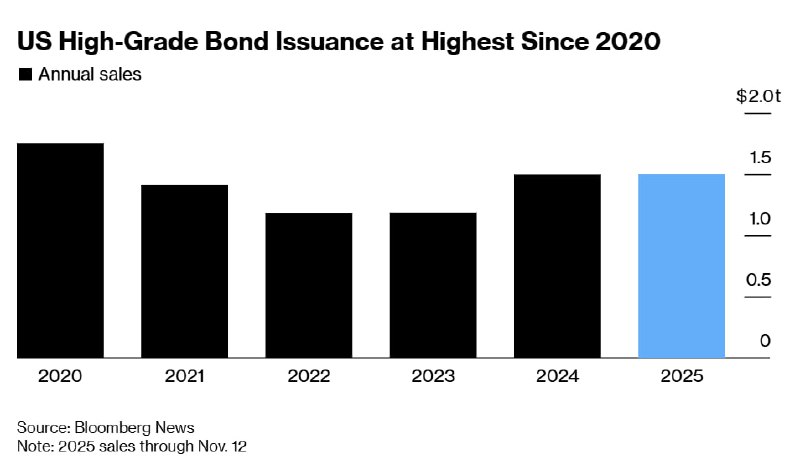

US investment‑grade bond sales have surged to their highest level since 2020, with 2025 issuance through November 12 already outperforming recent years. Large corporations are rushing to lock in cheaper borrowing costs, fueling a wave of high‑grade debt deals.

Key Developments

- Investment‑grade (high‑grade) bond issuance in the US is at its strongest since 2020.

- The data reflect 2025 year‑to‑date activity through November 12.

- Corporate issuers are accelerating deals to secure favorable financing while conditions remain supportive.

The current pace places 2025 among the most active years for US high‑grade debt since the pandemic‑era peak.

What’s Driving the Issuance

- Lower effective borrowing costs: Companies are taking advantage of relatively attractive yields to refinance existing debt and fund operations.

- Front‑loading supply: Issuers often concentrate deals when windows are open to reduce interest expense and interest‑rate risk.

- Balance‑sheet optimization: High‑grade borrowers are extending maturities and smoothing debt profiles ahead of potential market volatility.

Market Impact

Strong US investment‑grade supply typically signals:

- Robust corporate refinancing and improved liquidity profiles

- Potential support for equity and risk sentiment, as firms shore up capital structures

- A constructive backdrop for broader asset markets, including digital assets, where macro liquidity and rate expectations often influence flows

Outlook

If financing conditions remain favorable, issuance could stay elevated into year‑end and early 2026 as treasurers continue to term out debt. A sustained rise in yields, however, could slow the pace. For crypto markets, the trajectory of corporate borrowing costs and overall liquidity remains an important macro signal to watch.