Lead

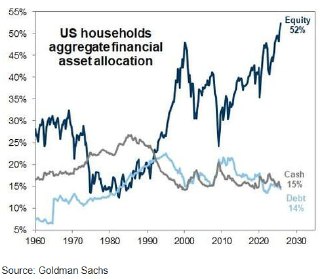

US household portfolios are now more heavily tilted toward equities than at any point on record, with 52% of aggregate financial assets in stocks as of 2023. The level surpasses the peak of the early-2000s dot‑com era, while cash stands at 15% and debt at 14%, according to data visualized from Goldman Sachs.

Key Developments

- Equity allocation: 52% of US households’ aggregate financial assets

- Cash allocation: 15%

- Debt allocation: 14%

- The trajectory shows an upward trend in equity exposure since the 1980s, with notable acceleration after 2010.

Context and Trends

The data highlights a long-running shift toward equities in household balance sheets, reflecting prolonged low-rate environments and strong equity market performance over the past decade. While cash and debt allocations have shown relative stability over time, equity weights have steadily climbed and now sit at historical highs.

- The current exposure level exceeds the dot‑com bubble peak, underscoring elevated risk appetite among retail investors.

- The increased equity concentration follows years of rising stock valuations and broad participation through retirement accounts and passive investment vehicles.

Implications for Crypto and Markets

- A record-high equity share may heighten sensitivity to stock market volatility. Any broad rebalancing from equities could influence flows into cash, fixed income, or alternative assets, including Bitcoin and crypto.

- For digital assets, shifts in risk sentiment tied to equities often ripple through crypto markets, potentially affecting correlation, liquidity, and trading volumes.

Looking Ahead

With equity allocations at historical extremes, market participants will watch for signs of rebalancing, changes in risk appetite, and macro catalysts that could steer flows between stocks, cash, bonds, and alternative assets. The high starting point for equities may shape portfolio decisions and volatility dynamics in both traditional and crypto markets.