Lead

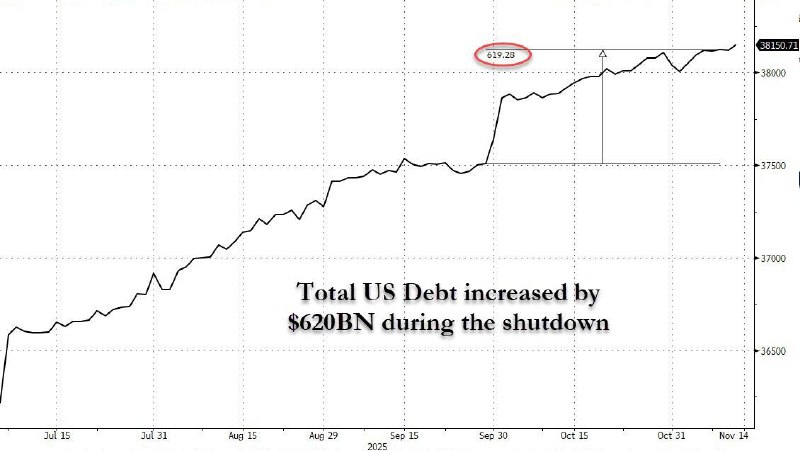

The U.S. national debt surged by approximately $620 billion over a short window tied to a fiscal standoff and subsequent lifting of borrowing constraints, according to Treasury data. By November 2015, total debt stood at $18.152 trillion, reflecting a sharp catch-up as deferred obligations were recognized.

Key Developments

- A Treasury debt chart spanning mid-2015 through November 2015 shows a notable jump in total U.S. debt levels.

- A highlighted data point marks total debt at $18,152.38 billion (about $18.152 trillion).

- The increase of about $620 billion occurred as the government navigated a budget impasse and resolved debt-limit constraints, a period often associated with temporary operational disruptions and delayed accounting of obligations.

Why the Spike Happened

When the federal debt ceiling is reached, the Treasury typically deploys "extraordinary measures" to remain under the limit, effectively deferring certain obligations. Once the ceiling is lifted or suspended, these deferred obligations are promptly recognized, often producing a large, sudden increase in reported debt outstanding.

The observed $620 billion jump reflects the unwinding of these measures and the normalization of the government’s balance sheet after the constraint period.

Broader Context and Market Relevance

- The late-2015 total of $18.152 trillion underscores the steady upward trajectory of U.S. borrowing needs.

- Periods of fiscal brinkmanship and rapid debt adjustments can influence risk sentiment across financial markets.

- For cryptocurrency markets, sustained concerns over sovereign debt dynamics and policy uncertainty are often cited as drivers of interest in decentralized assets like Bitcoin, which some investors view as a hedge against fiscal and monetary risks.

Conclusion

The rapid $620 billion increase in U.S. debt, culminating in a total of $18.152 trillion by November 2015, highlights how debt-limit episodes can produce abrupt shifts in federal borrowing figures. Future budget standoffs and debt ceiling negotiations remain key macro variables for traditional and crypto markets alike.