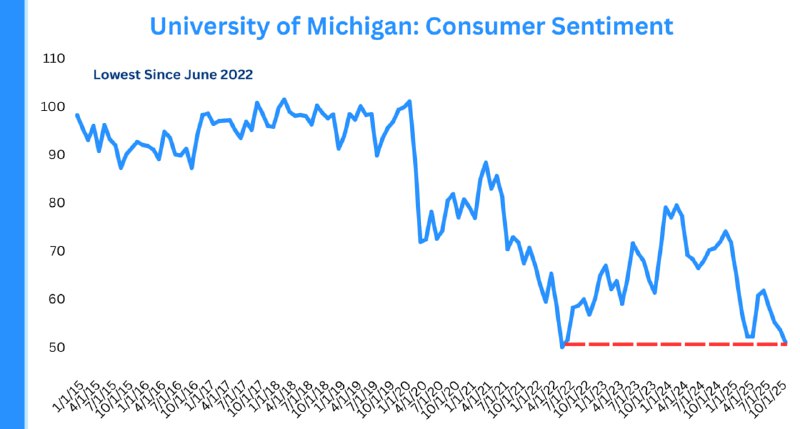

U.S. Consumer Sentiment Hits Two-Year Low

The University of Michigan's Consumer Sentiment Index fell to 51.0, slightly above expectations of 50.5 but below the prior reading of 53.6. The latest figure marks the lowest level since June 2022, underscoring persistent weakness in household outlook and confidence.

Key Developments

- Headline index: 51.0

- Consensus forecast: 50.5

- Previous reading: 53.6

- Milestone: Lowest since June 2022

A decline to these levels typically signals cautious consumer behavior amid concerns about personal finances, business conditions, and the broader economic outlook. The University of Michigan’s survey is a closely watched gauge of sentiment that can influence expectations for consumer spending and economic growth. University of Michigan Surveys of Consumers

Why It Matters for Crypto

- Macro sensitivity: Digital assets, including Bitcoin and Ethereum, often respond to shifts in macro sentiment, liquidity expectations, and interest-rate outlooks. Weak consumer sentiment can heighten recession concerns, which may sway risk appetite across equities and crypto.

- Policy implications: Softer sentiment—if sustained alongside other cooling indicators—can shape expectations for the Federal Reserve’s policy path, potentially affecting yields, the U.S. dollar, and speculative assets.

Market Context

The chart accompanying the latest reading highlights a downtrend in sentiment, with levels now hovering near 50, a zone historically associated with subdued confidence. While the immediate impact on crypto prices may vary, traders are likely to monitor:

- Upcoming inflation data and labor market reports

- Changes in rate expectations and bond yields

- Broader risk-on/risk-off shifts that influence crypto flows

Looking Ahead

Market participants will watch whether sentiment stabilizes or continues sliding in the coming months. A prolonged slump could imply softer consumer spending and slower growth—factors that tend to drive cross-asset volatility, including in the crypto market.