Key Takeaway

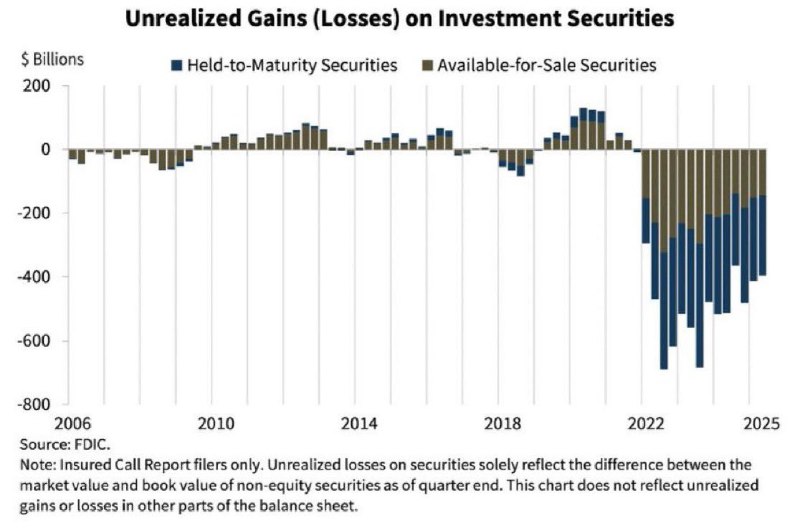

US banks carried an estimated $395 billion in unrealized losses on investment securities as of Q2 2025, reflecting ongoing pressure from elevated interest rates. While still substantial, the total is below the peak losses that exceeded $600 billion during 2023–2024, based on Federal Deposit Insurance Corporation (FDIC) reporting trends.

Key Developments

- Unrealized losses are concentrated in banks’ portfolios of Held-to-Maturity (HTM) and Available-for-Sale (AFS) securities.

- The figures reflect data for insured Call Report filers, as tracked by the FDIC.

- Losses surged beginning in 2022 as bond prices fell amid rapid interest-rate increases, and remained elevated through 2024, before narrowing to $395 billion by Q2 2025.

"Unrealized losses are the difference between market value and book value of non-equity securities as of quarter end."

Context and Drivers

Banks’ unrealized losses rose sharply when policy rates increased, pushing down the market value of longer-duration U.S. Treasuries and mortgage-backed securities widely held on bank balance sheets. The negative marks are most visible in:

- AFS securities, where market value changes flow through accumulated other comprehensive income (AOCI), and

- HTM securities, which are carried at amortized cost but can still reflect sizable economic losses if sold before maturity.

The persistence of elevated yields has kept a significant portion of these paper losses in place, even as the aggregate total appears to have improved from the 2023–2024 highs.

Why It Matters for Markets

- Capital and liquidity management: Large unrealized losses can constrain flexibility, particularly if institutions need to sell securities and recognize losses to meet liquidity needs.

- Lending and risk appetite: Balance-sheet pressure may weigh on credit creation and risk-taking across traditional finance, with potential knock-on effects for broader markets, including digital assets.

- Macro sensitivity: The trajectory of bank securities valuations remains closely tied to the path of interest rates and Treasury yields.

Outlook

The size of banks’ paper losses will largely track interest-rate moves:

- Declining yields would likely reduce unrealized losses by lifting bond prices.

- Higher-for-longer rates would keep losses elevated and continue to test balance-sheet resilience.

With unrealized losses at $395 billion in Q2 2025, the sector remains sensitive to rate volatility, even as conditions have improved from the worst levels observed in 2023–2024.