Lead

U.S. employers have announced more than 1,000,000 job cuts year to date, according to the latest Challenger job cuts data. The surge places 2025 among the most aggressive layoff years on record and could influence expectations for Federal Reserve policy, risk appetite, and broader crypto market sentiment.

Key Developments

- The cumulative number of announced job cuts in the U.S. has exceeded 1 million so far this year.

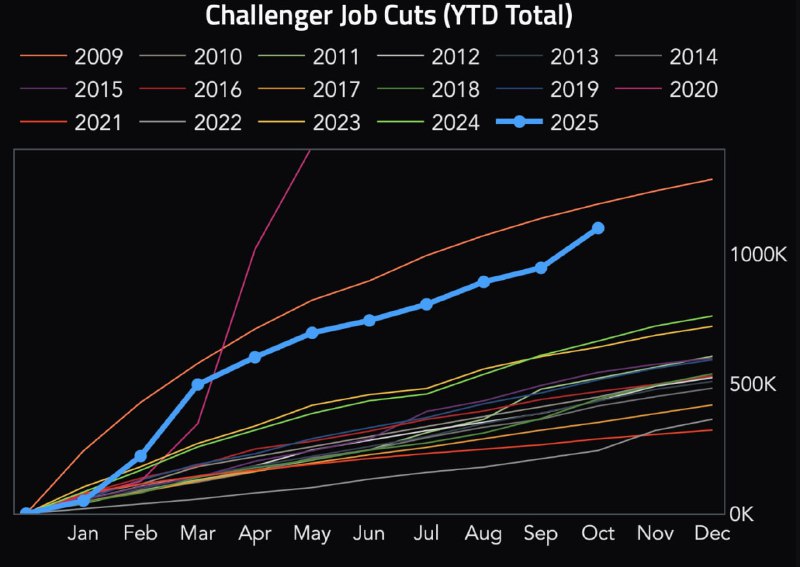

- A chart labeled “Challenger Job Cuts (YTD Total)” shows a steep upward trajectory for 2025, signaling an unusually rapid accumulation of layoffs.

- Historically, 2020 remains the outlier peak, with YTD cuts surpassing 1,000,000 during the pandemic shock.

- In 2023, the YTD total crossed 500,000 by mid-year, highlighting an elevated layoff pace compared to pre-pandemic norms.

Context and Why It Matters

The Challenger, Gray & Christmas report tracks announced job cuts, which reflect employer intentions rather than realized layoffs or the unemployment rate. Still, sharp increases in announced cuts often coincide with slowing growth, rising cost pressures, or business-model adjustments.

- A deteriorating labor backdrop can reshape Federal Reserve expectations by increasing the probability of rate cuts, which in turn can influence Treasury yields, the U.S. dollar, and risk-sensitive assets.

- Crypto assets, including Bitcoin, tend to react to shifts in liquidity and macro risk sentiment. Historically, easier financial conditions and falling yields have supported risk assets, while growth scares can drive volatility.

Announced job cuts provide an early signal of corporate belt-tightening, often preceding broader labor market softness captured in official metrics like BLS employment reports.

Market Impact

While the immediate reaction in digital assets can vary, traders are watching how elevated layoffs interact with:

- Rate-cut timing and guidance from the Federal Reserve

- Movements in Treasury yields and the U.S. dollar index (DXY)

- Cross-asset risk appetite across equities, tech, and crypto

Sustained labor market softness could support a lower-rate narrative—historically a tailwind for liquidity-sensitive assets—but it also raises concerns about earnings, growth, and volatility that can weigh on Bitcoin and altcoins.

What to Watch Next

- Upcoming nonfarm payrolls, jobless claims, and CPI prints for confirmation of labor softening.

- Fed communications on the balance between inflation risks and rising unemployment risk.

- Crypto market internals—stablecoin flows, derivatives funding, and BTC’s correlation with tech equities.

For reference and further data, see Challenger, Gray & Christmas and the Bureau of Labor Statistics.

Conclusion

With announced U.S. job cuts surpassing 1 million YTD, markets face a more complex macro setting. For crypto, the balance between potential policy easing and growth risks will likely dictate near-term direction and volatility.