Lead

Stream Finance reported a $93 million loss, triggering a sharp 50% depeg in its algorithmic stablecoin xUSD. Analysts warn that interconnected exposures across synthetic assets and lending protocols could place up to $285 million in DeFi liquidity at risk.

Key Developments

- Stream Finance confirmed a loss of approximately $93M.

- The platform’s algorithmic stablecoin xUSD depegged by about 50%, falling close to $0.50.

- Due to cross-collateralization and synthetic asset dependencies (including xUSD, xBTC, and xETH), analysts estimate potential systemic exposure of up to $285M across related DeFi protocols.

Potential Exposure by Protocol

- TelosC: up to $123.6M

- Elixir: $68M (with approximately 65% of the stablecoin deUSD reserves reportedly deployed in Stream)

- MEV Capital: up to $25.4M

These figures reflect on-chain positions and collateral relationships that could be affected by xUSD’s instability and any cascading liquidations.

How the Risk Accumulated

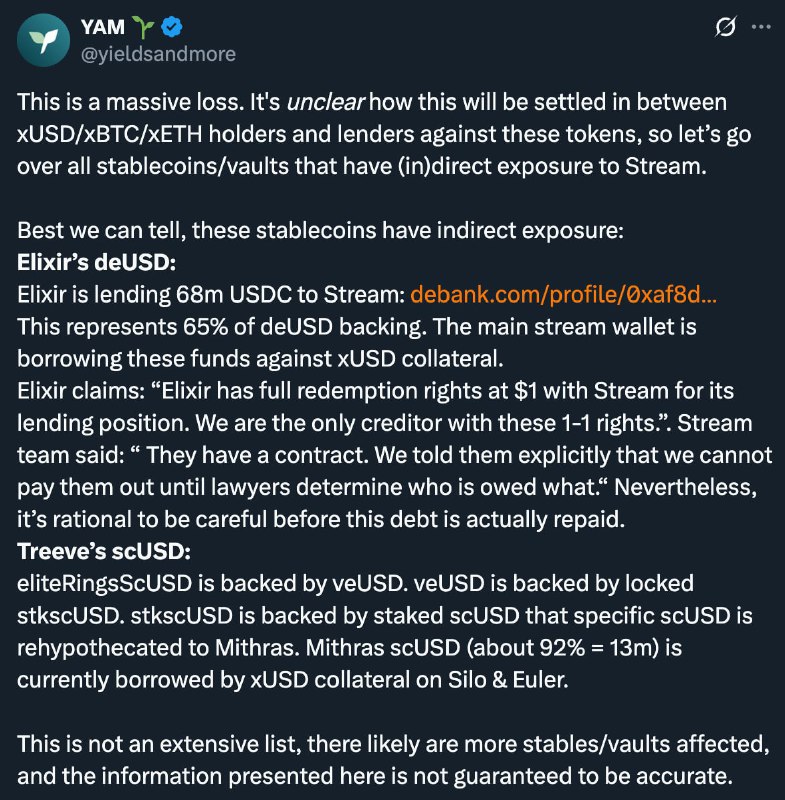

Analysts highlighted that the same assets were likely pledged repeatedly across protocols, creating an illusion of expanding liquidity without fresh capital inflows. This rehypothecation and circular borrowing may have amplified the system’s fragility:

- Elixir is shown lending around 68M xUSD, while borrowing approximately 65% against deUSD collateral.

- Trevee’s sCUSD is reportedly backed 94% by veUSD.

- The debt ratio of sCUSD to Mithras is about 81%, with Mithras borrowing roughly 92% against veUSD collateral.

These interdependencies mean that volatility or depegging in one token (such as xUSD) can ripple through multiple positions, intensifying liquidation pressure and impairing redemption paths.

Governance and Redemption Uncertainty

There are indications of conflicting claims around redemption rights and control of certain assets, including reports that Elixir asserts full redemption rights over xUSD—potentially at odds with Stream’s control claims. Any misalignment here could slow or complicate redemptions, increasing market stress.

Market Impact

- xUSD’s depeg raises concerns about further cascading liquidations if participants unwind positions rapidly.

- Protocols with concentrated exposure to xUSD, veUSD, and related synthetic assets may face heightened solvency and liquidity risk.

- Participants are monitoring whether collateral buffers can absorb volatility without triggering forced selling.

What to Watch Next

- xUSD Repeg Efforts: Any steps by Stream Finance to restore the peg or recapitalize shortfalls.

- Protocol Disclosures: Clarifications from Elixir, TelosC, MEV Capital, and others on their current exposure and risk management.

- On-Chain Liquidations: Whether collateral thresholds are breached, prompting further deleveraging.

- Audit and Governance Actions: Independent assessments, treasury moves, or emergency proposals to stabilize the system.

Conclusion

The reported $93M loss at Stream Finance and the xUSD depeg have exposed structural vulnerabilities tied to synthetic assets and cross-collateralized lending. With potential systemic exposure estimated at $285M, market participants are bracing for continued volatility and closely watching for stabilization measures and transparent disclosures from affected protocols.