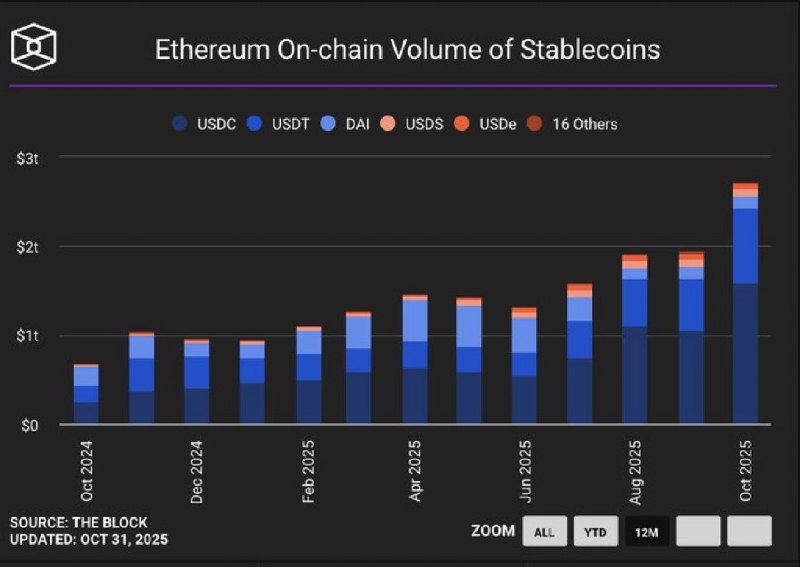

Lead Stablecoin trading volume on the Ethereum network has surged, underscoring robust demand for on-chain liquidity and settlement. The jump highlights Ethereum’s continued role as a core infrastructure layer for dollar-pegged digital assets.

Body Stablecoins—crypto assets pegged to fiat currencies such as the US dollar—are widely used for trading, payments, and settlement across decentralized finance (DeFi). A surge in their trading volumes on Ethereum typically signals heightened on-chain activity, deeper liquidity, and stronger demand for rapid, programmable settlement.

Ethereum remains a key venue for major stablecoins like USDT and USDC, supporting use cases that range from decentralized exchange (DEX) trading and lending to merchant payments and institutional transfers. Rising stablecoin throughput can also influence gas demand and network fees, prompting users and applications to optimize transactions across layer-2 networks such as Arbitrum, Base, and Optimism.

While the latest spike reflects strong market participation, it also draws attention to broader trends, including the growing integration of stablecoins in payments and the continued migration of activity between Ethereum’s mainnet and scaling solutions. Developers and traders will be watching whether elevated volumes persist and how they impact liquidity, fee dynamics, and cross-chain flows.

Conclusion The surge in stablecoin trading on Ethereum points to durable on-chain demand and reinforces the network’s role in crypto market infrastructure. Sustained activity could shape fee markets, liquidity distribution, and adoption across Ethereum and its layer-2 ecosystem.