Lead

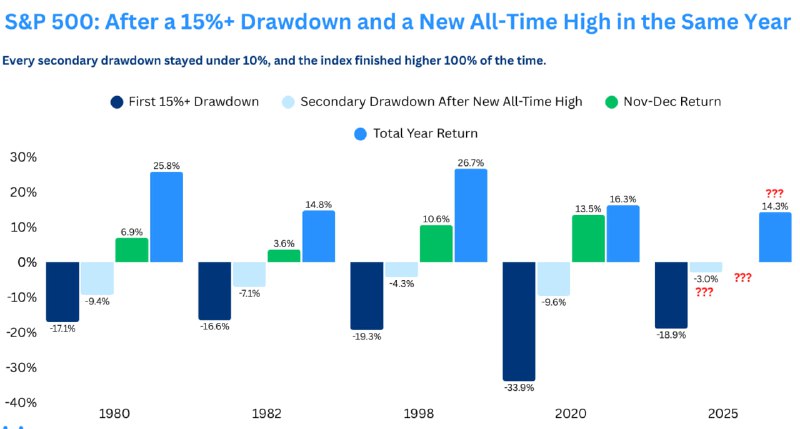

The S&P 500 has entered a historically rare setup: it experienced a drawdown of more than 15% while also reaching a new all-time high within the same year. Historical precedents suggest that follow-on losses were contained and year-end performance tended to be positive—factors that could influence risk appetite across crypto markets.

Key Developments

- This marks only the fifth time the S&P 500 has both fallen over 15% and set a record high in the same calendar year.

- In all previous instances, secondary losses remained below 10%.

- The November–December period delivered positive returns in those prior cases.

Why It Matters for Crypto

Crypto assets, including Bitcoin, often trade in tandem with broader risk sentiment. A stock market backdrop featuring limited downside follow-through and constructive year-end seasonality has historically supported risk-on positioning. While correlations between equities and digital assets can shift, a resilient S&P 500 into year-end may:

- Bolster investor confidence and liquidity conditions

- Improve risk tolerance that can spill over into Bitcoin and altcoins

- Support momentum strategies that typically benefit from positive seasonality

Market Context

Investors will watch whether the current pattern repeats the historical playbook—moderate secondary pullbacks and positive late-year performance. That said, macro forces such as interest-rate expectations, inflation trends, and liquidity remain decisive variables for both equities and crypto.

Conclusion

If history rhymes, a contained equity pullback and constructive year-end could underpin broader risk assets, including cryptocurrencies. However, market participants should remain mindful of shifting macro drivers that can alter cross-asset correlations and volatility.