Lead

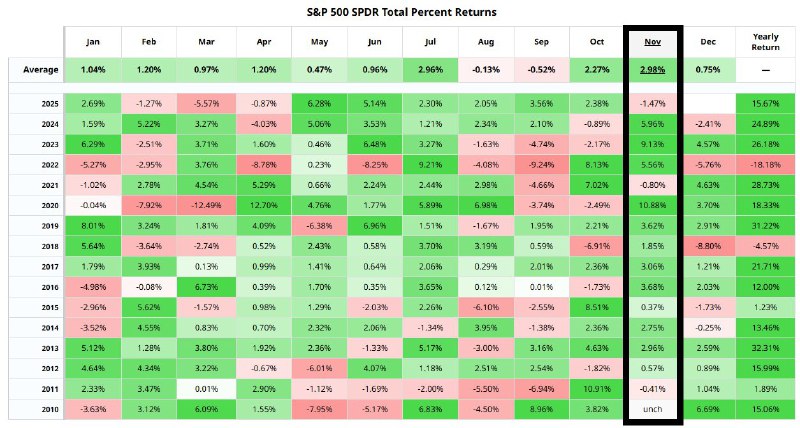

The S&P 500 is faltering in November, a month that historically delivers outsized gains for U.S. equities. Historical performance data for the SPDR S&P 500 ETF Trust (SPY) from 2010 to 2023 shows November averaging +2.89%, second only to April’s +2.96%. The stumble is drawing attention from crypto traders given the cross-asset correlation between equities and digital assets.

Key Developments

Historical monthly total returns for SPY (2010–2023) highlight pronounced seasonality:

- November average: +2.89%

- April average: +2.96% (highest monthly average)

- January average: −0.03%

- Best full-year return: 2013 at +32.31%

- Worst full-year return: 2018 at −4.56%

These figures underscore why November is often seen as a tailwind for risk assets. A weak performance this month would buck that trend and signal heightened caution into year‑end.

Market Impact

- Risk sentiment: Equities’ soft November performance can pressure broader risk assets, including Bitcoin and major altcoins, as portfolio de-risking often ripples across correlated markets.

- Correlation watch: While crypto sometimes diverges, periods of equity weakness have historically coincided with higher crypto volatility and thinner liquidity.

- Seasonality vs. macro: Strong seasonality alone may not offset macro headwinds such as tighter financial conditions or growth concerns.

Why It Matters for Crypto

- Bitcoin and equities have shown episodic positive correlation, especially during macro-driven risk-off moves.

- A weaker-than-usual November for stocks can temper the typical year-end rally narrative in crypto, even as digital assets pursue idiosyncratic catalysts like protocol upgrades or ETF flows.

Looking Ahead

Traders will watch upcoming macro releases, central bank commentary, and liquidity dynamics into year-end. If equities fail to reclaim November’s historical strength, crypto markets may see elevated volatility and more selective risk-taking.

Historical performance is not indicative of future results. Seasonality can inform context, but macro catalysts remain decisive for both stocks and digital assets.