Lead

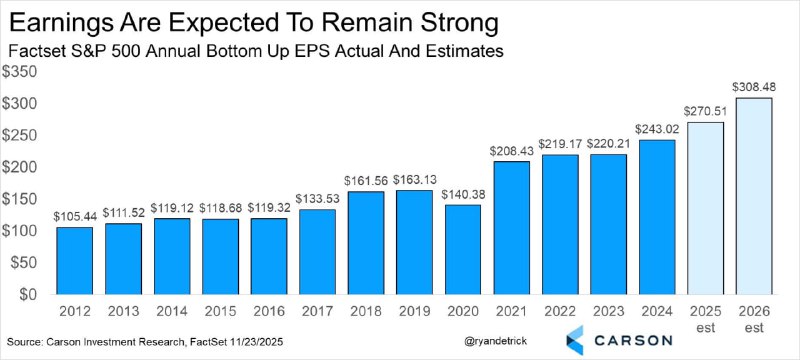

S&P 500 corporate earnings are projected to rise 11.3% this year and 14% next year, based on bottom-up EPS estimates. The trajectory suggests earnings could reach new highs by 2026, reinforcing the view that earnings growth remains a key driver of market performance.

Key Figures

- Bottom-up S&P 500 EPS has climbed from $105.44 in 2012 to an estimated $308.48 in 2026, according to data compiled from FactSet and industry research as of December 31.

- The series shows a notable pandemic-era dip to $122.41 in 2020, followed by a sharp recovery to $204.38 in 2021.

- Current forecasts call for +11.3% EPS growth this year and +14% next year, underscoring expectations for continued strength in corporate profitability.

Why It Matters for Markets

- Earnings growth historically exhibits one of the strongest correlations with equity returns. A sustained uptrend in bottom-up EPS typically supports broader risk sentiment.

- For digital assets, a constructive macro backdrop in equities can enhance risk appetite across markets, potentially influencing crypto market flows and volatility.

Context and Methodology

- The figures reflect bottom-up EPS—the sum of individual analyst earnings estimates for S&P 500 constituents—compiled into an index-level outlook using FactSet data and analysis referenced by Carson Investment Research (Carson Group).

- The historical pattern shows steady long-term growth with short-term cyclical drawdowns, notably in 2020, followed by rapid normalization.

What to Watch Next

- Revisions to forward EPS in coming quarters will be critical for confirming the projected +11.3% and +14% growth path.

- Profit margins, revenue trends, and sector-level dynamics could influence whether the 2026 EPS estimate of $308.48 is maintained or adjusted.

Conclusion

Projected gains in S&P 500 earnings—double-digit growth over the next two years and a path to record EPS by 2026—reinforce a constructive macro backdrop. While revisions bear close monitoring, the current outlook supports broader risk sentiment that can ripple through both equities and crypto markets.