Lead

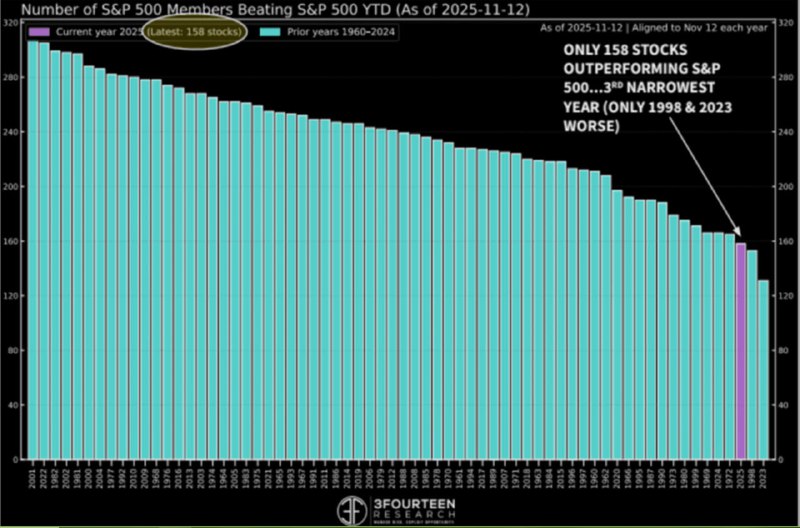

The S&P 500’s rally in 2023 was unusually concentrated: only 158 constituents outperformed the index, marking the third narrowest market breadth since 1960. At the same time, the share of stocks lagging the benchmark by at least 10% ranked as the fourth largest on record. The extreme concentration raises broader risk considerations for equities and potentially for crypto markets.

Key Numbers

- 158 S&P 500 stocks outperformed the index in 2023

- 3rd narrowest breadth year since 1960

- The share of constituents trailing by ≥10% was the 4th largest on record

- Only two years since 1960 recorded narrower outperformance breadth, including 1998

Why It Matters

Market breadth gauges how widespread gains are across an index. Narrow breadth often signals that index performance is driven by a small group of mega-cap leaders, while many constituents lag. Such concentration can:

- Increase volatility if leadership stumbles

- Heighten portfolio concentration risk for passive investors

- Influence risk appetite across asset classes, including Bitcoin and other digital assets

For crypto markets, prolonged equity concentration can cut both ways: it may reinforce flows into a handful of high-beta names and digital assets during risk-on phases, but it can also amplify downside during risk-off episodes. Crypto traders often watch breadth indicators alongside equal-weight vs. cap-weight S&P 500 performance to gauge underlying market health.

Historical Context

- The current reading places 2023 among the most narrowly led equity years in over six decades.

- Historically, years with extreme concentration—such as 1998—have preceded periods of heightened volatility as leadership rotates or broadens.

Implications for Crypto

- Narrow breadth in equities can signal fragile risk sentiment, a key input for Bitcoin, Ethereum, and high-beta altcoins.

- A broadening of equity participation may support a more durable risk-on environment, potentially benefiting crypto.

- Conversely, a reversal in equity leaders without broad support could pressure correlated risk assets.

Looking Ahead

Traders may track:

- Breadth indicators (advancers/decliners, percent of stocks above moving averages)

- Equal-weight S&P 500 versus cap-weight S&P 500 spreads

- Cross-asset correlations between major equity indices and crypto

A sustained improvement in breadth would indicate healthier underlying market participation, while continued narrow leadership keeps concentration risk front and center for both equities and digital assets.

For background on the index, see the S&P 500 overview.