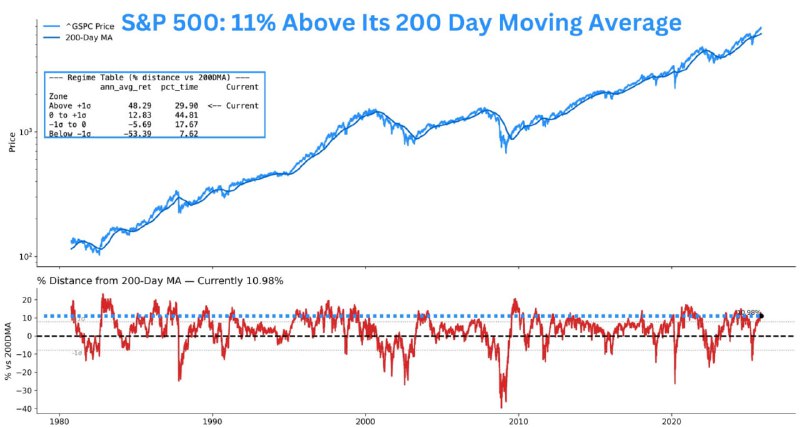

The S&P 500 is trading about 11% above its 200-day moving average, a level roughly one standard deviation above typical readings. Historically, the SPY ETF has occupied this zone only around 30% of the time, a range that has been associated with comparatively stronger forward returns.

Key Developments

- The S&P 500 currently stands about 11% above its 200-day moving average (200-DMA).

- This distance is approximately one standard deviation above the long-term norm.

- The SPDR S&P 500 ETF Trust (

SPY) has historically spent about 30% of its time in this regime. - Historically, this area has corresponded with higher forward returns, though outcomes vary across cycles.

Why the 200-Day Moving Average Matters

The 200-day moving average is a widely watched trend gauge used to assess the market’s longer-term direction. Sustained trading above the 200-DMA often signals broad uptrend momentum, while extended distances from the average can reflect overextension risks and the potential for mean reversion.

- Learn more about the 200-DMA: Investopedia – 200-Day Moving Average

- Index overview: S&P 500 – S&P Dow Jones Indices

- ETF reference: SPDR S&P 500 ETF Trust (SPY)

Market Impact

Strength above the 200-DMA tends to bolster risk appetite, which can spill over into risk assets, including the cryptocurrency market. While equities and digital assets do not move in lockstep, periods of broad market confidence have at times coincided with firmer Bitcoin and altcoin performance. That said, correlations between stocks and crypto are regime-dependent and can shift quickly.

What to Watch

- Whether the index consolidates at elevated levels or reverts toward the 200-DMA.

- Shifts in volatility around earnings, inflation data, and central bank updates.

- Any change in cross-asset correlations that could influence Bitcoin and broader crypto sentiment.

Conclusion

The S&P 500’s position 11% above its 200-day average places it in a historically notable regime linked to stronger returns. Traders will be watching whether momentum persists or fades toward the long-term trend, with potential knock-on effects for broader risk assets, including cryptocurrencies.