Lead

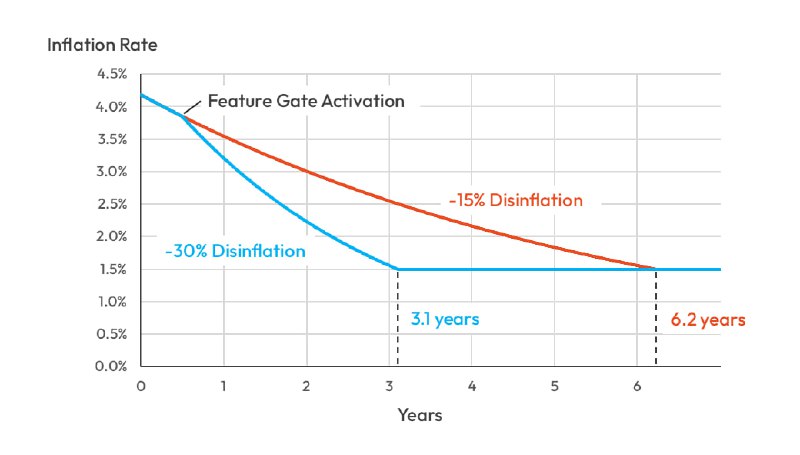

The Solana community has introduced proposal SIMD-0411 to double the network’s disinflation rate from 15% to 30%. The change aims to accelerate the decline of SOL inflation from the current ~4.18% to a long-term target of 1.5% by early 2029 instead of 2032, while reducing potential token issuance by approximately 22.3 million SOL over six years.

Key Developments

- Disinflation adjustment: The proposal would increase the annual rate at which Solana’s inflation decays, moving from a -15% to -30% disinflation schedule.

- Faster timeline to target: Modeling indicates the 1.5% inflation target would be reached in roughly 3.1 years after a feature activation, versus 6.2 years under the current schedule—translating to an expected arrival by early 2029 rather than 2032.

- Lower issuance: The adjustment is projected to cut potential issuance by about 22.3 million SOL over a six-year period.

- Staking dynamics: SIMD-0411 is designed to ease pressure on staking yields and increase average lock times, potentially strengthening network security incentives.

- Governance status: The proposal is under discussion and has not yet been finalized or activated. A feature-gated activation would implement the new schedule once approved.

Why It Matters

Solana’s tokenomics employ a disinflationary schedule, where the inflation rate declines by a set percentage each year toward a long-term floor. By doubling disinflation to 30%, the network would reduce inflation more quickly from roughly 4–4.5% today toward the 1.5% target, potentially improving supply dynamics and staking incentives while maintaining validator participation.

Visual Modeling Highlights

- A comparative model shows:

- At 30% disinflation, inflation converges to ~1.5% in about 3.1 years after feature activation.

- At 15% disinflation, the same target is reached in about 6.2 years.

These trajectories illustrate how the proposed change shortens the transition period by roughly half, aligning earlier with the network’s long-term inflation objective.

What’s Next

The community will continue to debate SIMD-0411’s implications for security, staking rewards, and supply before any activation. If adopted, the feature gate mechanism would roll out the new schedule, with the accelerated path to 1.5% inflation becoming effective thereafter.

Conclusion

If implemented, SIMD-0411 would mark a notable shift in Solana’s monetary policy—accelerating disinflation, reducing future SOL issuance, and potentially improving staking dynamics. The proposal remains in the discussion phase, with further governance steps expected before any network changes take effect.