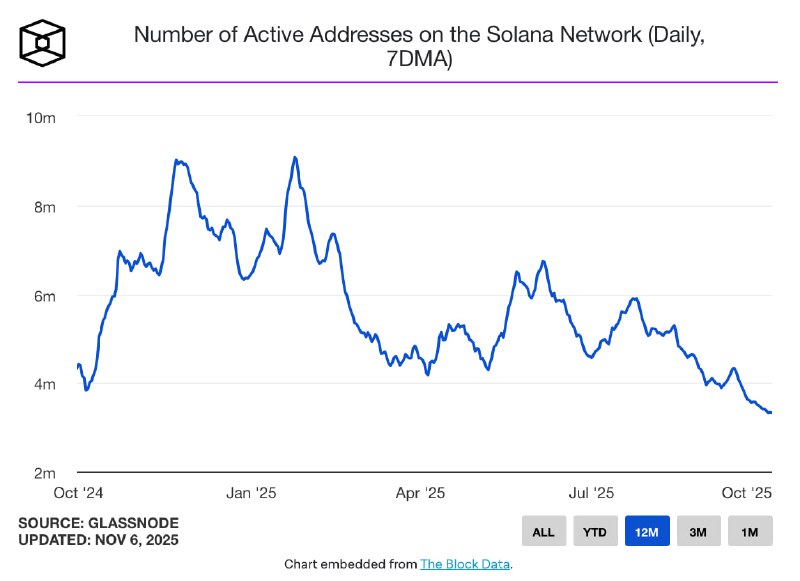

Solana’s daily active addresses have fallen to about 3.3 million, a 12‑month low and nearly a third of the network’s peak of roughly 9–10 million seen around January 2025 amid the memecoin trading boom. Despite the slowdown in user engagement, Solana’s DeFi footprint remains sizable, with TVL near $10 billion, and launchpad activity led by Pump.fun, which continues to generate over $1 million per day and hold about 90% market share.

Key Developments

- Active addresses slump: On-chain metrics show Solana’s 7‑day moving average of daily active addresses declining from peaks near 9–10 million in late 2024/early 2025 to below 4 million by October 2025, reaching roughly 3.3 million in early November.

- Memecoin cycle cools: Activity surged when Solana became a leading venue for launching and trading memecoins, but interest has since eased, weighing on daily user counts.

- Resilient launchpad revenue: Pump.fun remains an outlier with strong traction—bringing in $1M+ per day and maintaining roughly 90% share among Solana launchpads.

Ecosystem Context

While headline engagement has softened, Solana continues to invest in core infrastructure and new applications:

- New DEXs, prediction markets, and RWA solutions are expanding use cases.

- Developer activity remains relatively high, suggesting efforts to build a more durable foundation beyond speculative trading.

DeFi Standing and Liquidity

- TVL near $10B keeps Solana firmly in the No. 2 spot among smart‑contract platforms by locked value, trailing only Ethereum.

- Liquidity and usage are concentrated in leading Solana DeFi projects including Jupiter, Kamino, and Jito.

Why It Matters

The rapid shift from a memecoin‑driven surge to a moderation in activity highlights how quickly trends can turn in crypto. Networks that scale around a single dominant use case can be more vulnerable when user attention pivots. Solana’s continued infrastructure build‑out and diversified app growth will be key to stabilizing engagement.

Outlook

Sustained growth will likely hinge on adoption of non‑speculative use cases and the success of high‑throughput DeFi, RWA integrations, and consumer apps. If Solana’s developers and protocols convert ongoing build momentum into broader utility, the network could steady user activity even as memecoin trading cools.