Lead

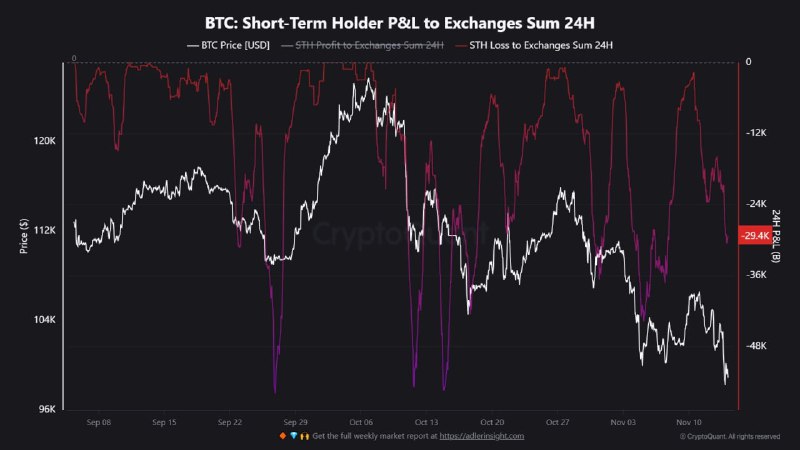

On-chain data indicates that short-term Bitcoin holders sent approximately 29,400 BTC to exchanges over the past 24 hours while realizing losses. The surge in the Short-Term Holder P&L to Exchanges Sum (24H) metric points to rising sell-side pressure and the potential for elevated volatility.

Key Developments

- The metric titled "BTC: Short-Term Holder P&L to Exchanges Sum (24H)" spiked to around -29.4k BTC, signaling that coins held by recent buyers were transferred to exchanges at a loss.

- This flow typically reflects capitulation-like behavior among short-term holders (STH)—commonly defined as investors holding coins for a relatively brief period—who may be more sensitive to price swings.

- A highlighted value on the chart showed a loss marker near -29.4, consistent with the reported magnitude of realized-loss transfers to exchanges.

Market Context

- Historically, pronounced increases in STH loss-to-exchanges can align with periods of market stress, as weak hands reduce exposure.

- Such spikes may precede either continued downside (if broader risk-off conditions persist) or a local bottom formation when aggressive sellers exhaust.

- Elevated exchange inflows often increase immediate sell liquidity, which can amplify short-term price moves.

Why It Matters

- Large realized losses among short-term cohorts suggest negative sentiment and pressure on spot markets.

- Monitoring this metric helps traders gauge whether panic-driven flows are tapering or accelerating.

What to Watch Next

- Exchange balance trends and net flows

- Derivatives positioning and funding rates

- Realized profit/loss across other cohorts (e.g., long-term holders)

- On-chain indicators of holder resilience versus distribution

Conclusion

The move of roughly 29,400 BTC to exchanges at a loss underscores heightened uncertainty among short-term participants. Whether this wave marks a final capitulation or the start of deeper distribution will hinge on follow-through signals in exchange flows, derivatives metrics, and broader market risk appetite.