Lead

A study from Schwab indicates robust mainstream interest in digital assets, with 45% of ETF investors planning to invest in cryptocurrency ETFs—on par with bonds/fixed income (45%) and second only to U.S. equities (52%). The findings underscore crypto's growing role in diversified ETF portfolios.

Key Findings

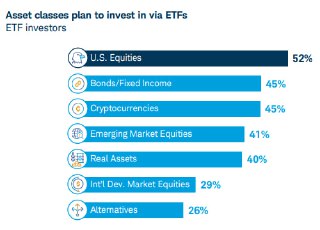

The survey highlights how ETF investors are allocating future capital across asset classes:

- U.S. Equities: 52%

- Bonds/Fixed Income: 45%

- Cryptocurrencies: 45%

- Emerging Market Equities: 41%

- Real Assets: 40%

- International Developed Market Equities: 29%

- Alternatives: 26%

Interest in cryptocurrency ETFs now rivals bonds among ETF investors, signaling a notable shift in portfolio preferences.

Context and Implications

- Strong intent to buy crypto ETFs suggests sustained demand following high-profile spot Bitcoin ETF launches and rising discussion around potential Ethereum and multi-asset crypto products.

- Parity with bonds—a traditional defensive allocation—indicates that investors view crypto ETFs as a viable component of diversified strategies rather than a niche speculation.

- Continued interest in U.S. equities (52%) keeps traditional markets at the forefront, but the 45% figure for crypto underscores a meaningful broadening of investor appetites.

Market Impact

- ETF issuers may respond with expanded product lineups, including thematic and multi-asset crypto strategies.

- Advisors and platforms could see increased demand for education, risk frameworks, and compliance tools for digital asset exposure within ETF wrappers.

- If intent translates into flows, crypto ETF volumes may remain resilient, supporting liquidity and price discovery across listed products.

Looking Ahead

As more regulated crypto ETFs reach the market, investor education and clarity on custody, fees, and tracking differences will be central to adoption. The survey’s results point to a maturing landscape where crypto competes directly with core asset classes in ETF-based portfolios.