Lead

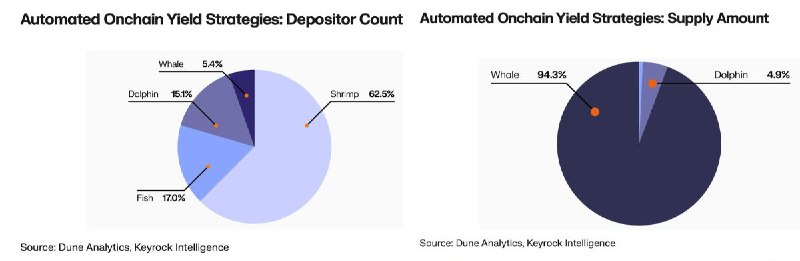

A new analysis of automated on-chain yield strategies shows a stark concentration of capital: while retail users make up the majority of depositors, a small cohort of large wallets controls nearly all the value. Retail addresses account for about 62% of depositors, yet just 5.4% of addresses—classified as whales—supply 94.3% of total value locked (TVL), underscoring the influence of institutional-sized capital in DeFi.

Key Findings

- Depositor composition:

- Shrimp (retail): 62.5% of depositor count

- Fish: 17.0%

- Dolphin: 15.0%

- Whale: 5.4%

- Supply by amount (TVL share):

- Whales: 94.3% of TVL

- Dolphins: 4.9%

- Shrimp: a negligible share (visually minimal in the chart)

These figures indicate that while most participants in automated on-chain yield strategies are smaller, retail-leaning depositors, the overwhelming majority of capital is concentrated among the largest wallets. The data was compiled using dashboards and analytics from Dune and research by Keyrock Intelligence.

Context and Definitions

Automated on-chain yield strategies typically include DeFi vaults and liquidity management products that programmatically allocate funds to generate returns. Community conventions often label wallets by size as:

- Shrimp: small retail holders

- Fish/Dolphin: mid-tier holders

- Whale: large holders, often institutional or professional capital

While labels are heuristic, the distribution here highlights that institutional-grade allocators are driving net flows into these strategies.

Why It Matters

- Market influence: With 94.3% of TVL in whale hands, strategy performance and risk can be highly sensitive to moves by a small number of large addresses.

- Liquidity dynamics: Concentrated capital can deepen liquidity but amplify outflow risks during stress events.

- Governance and fees: Large holders may exert disproportionate influence over protocol parameters, fee structures, and incentive programs.

- Product design: Protocols may need to balance features that attract big allocators while ensuring accessibility and resilience for retail users.

Outlook

As DeFi matures, capital concentration suggests professional allocators increasingly shape yield markets. Future developments—such as improved risk tooling, transparent reporting, and tailored vaults—could broaden participation while mitigating concentration risk. Continued monitoring of depositor composition and TVL distribution will be key indicators of how power dynamics in on-chain yield evolve.