Lead

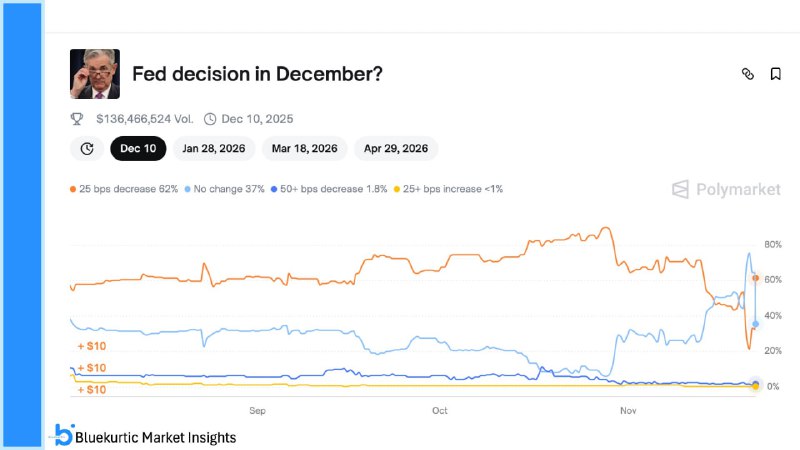

Prediction market data shows a sharp shift toward easier U.S. monetary policy in December. On Polymarket, the probability of a 25 basis point rate cut at the next Federal Reserve meeting jumped from 22% to 62%, while the odds of no change stand near 37%. The repricing could support risk sentiment across crypto markets.

Key Developments

- The likelihood of a 25 bps cut in December has surged to 62% on Polymarket, up from 22% previously.

- Markets are now assigning substantially lower chances to alternative outcomes, with no change around 37% and other scenarios at smaller probabilities.

- The move reflects a rapid shift in expectations for near-term U.S. interest rates, a critical macro factor for digital assets and broader risk markets.

The new pricing implies traders see a rate cut as the most likely December outcome, overtaking the prior base case of holding steady.

Market Impact on Crypto

Lower policy rates typically reduce funding costs and can encourage risk-taking, often benefiting assets like Bitcoin, Ethereum, and high-beta altcoins. A December rate cut could:

- Ease financial conditions, potentially improving liquidity and risk appetite

- Support valuations for growth-oriented assets, including crypto

- Lower dollar yields, which can increase the appeal of non-yielding or alternative assets

While crypto prices can diverge from macro signals in the short term, sustained expectations of easier policy have historically aligned with stronger risk sentiment.

What’s Next

- Traders will watch for updates from the Federal Reserve and incoming macro data that could reinforce or challenge the current pricing.

- Key focus areas include inflation momentum, labor market trends, and Fed communications ahead of the December decision. The Fed’s meeting schedule is available on the Federal Reserve website.

Conclusion

Prediction markets now see a December rate cut as the most probable outcome, marking a meaningful pivot in expectations. If confirmed, a 25 bps move could provide another tailwind for crypto risk appetite into year-end, though volatility is likely as new data and Fed signals arrive.