Lead

Crypto venture firm Paradigm staked 14.7 million HYPE tokens worth approximately $581 million and moved an additional 3 million HYPE to HyperEVM, likely connected to the Sonnet project. Following these moves, the SWPE ratio—defined as the token price to protocol revenue—fell to a new all-time low of 1.90.

Key Developments

- 14.7M HYPE staked (about $581M) a few hours ago

- 3M HYPE transferred to HyperEVM, reportedly tied to the Sonnet initiative

- SWPE ratio declined to a record low of 1.90, indicating compressed valuation relative to protocol revenues

The combination of significant staking activity and token movement to HyperEVM appears to have coincided with a sharp drop in the SWPE multiple, a metric traders watch to assess how a token’s market price compares to the income generated by its underlying protocol.

On-Chain Activity Snapshot

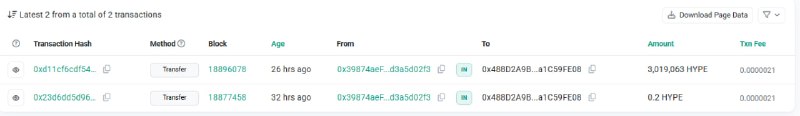

Recent blockchain records show ongoing activity in the HYPE ecosystem. Notably:

- Transfers include a transaction of approximately 3,919,963 HYPE alongside smaller moves (e.g., 0.2 HYPE) recorded about 26 hours prior

- Transaction fees observed were minimal, around 0.00000013, underscoring low-cost on-chain transfers

While these transfers illustrate active token flows, they do not by themselves attribute activity to any specific party.

Market Context and Implications

- A lower SWPE ratio often suggests that market valuation is lagging relative to protocol revenue, potentially setting the stage for re-pricing if fundamentals remain strong

- The move of 3M HYPE to HyperEVM may indicate expanding use cases or integrations, with Sonnet cited as a likely destination

- The scale of Paradigm’s stake signals sustained institutional engagement with the HYPE ecosystem

Looking Ahead

Traders and analysts will watch for follow-through from HyperEVM deployments, updates around Sonnet, and additional staking flows. With valuation multiples compressing, the market will assess whether HYPE can sustain momentum and potentially advance toward higher market-cap tiers.