Lead

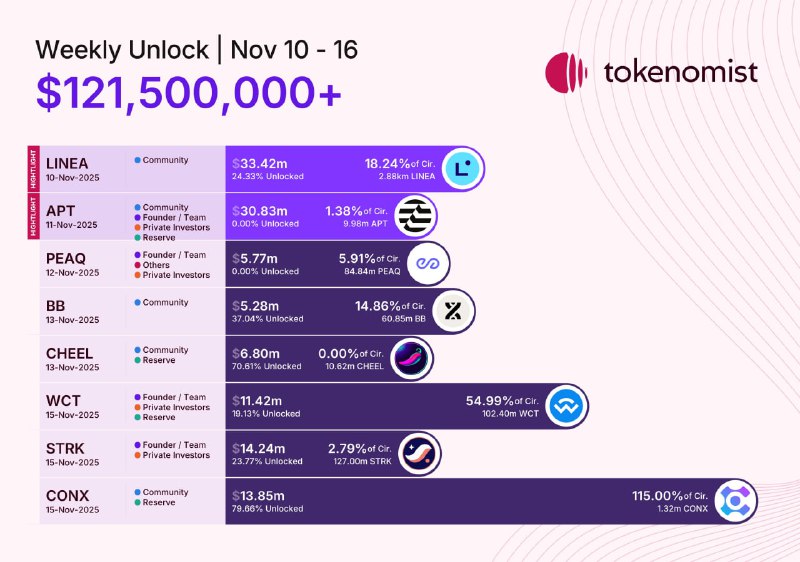

More than $100 million in cryptocurrency token unlocks are scheduled for next week, led by significant events for LINEA, APT, and STRK. The unlocks will increase circulating supply across multiple projects and could introduce short-term volatility in affected markets.

Key Developments

A slate of notable token unlocks is expected over the coming week, with the following highlighted amounts and estimated shares of circulating supply:

- LINEA (LINEA): $33.42 million — 18.24% of circulating supply

- Aptos (APT): $30.83 million — 1.38% of circulating supply

- Starknet (STRK): $14.24 million — 2.79% of circulating supply

- CONX (CONX): $17.07 million — 10.00% of circulating supply

- WCT (WCT): $11.42 million — 54.99% of circulating supply

- PEAQ (PEAQ): $5.77 million — 9.94% of circulating supply

- BB (BB): $5.28 million — 10.61% of circulating supply

- CHEEL (CHEEL): $5.04 million — 64.27% of circulating supply

Why It Matters

Token unlocks release previously vested or locked tokens into circulation. This typically includes allocations for teams, early investors, ecosystem incentives, or community rewards. Key implications include:

- Supply expansion: Increased circulating supply can weigh on prices if demand does not offset new tokens entering the market.

- Liquidity effects: Unlocks can improve liquidity but may heighten short-term volatility.

- Project milestones: Scheduled unlocks often align with roadmap events or distribution schedules.

Market Impact

- Large-percentage unlocks (e.g., CHEEL at 64.27% and WCT at 54.99%) may see sharper market reactions due to substantial supply changes.

- Large-dollar unlocks for LINEA, APT, and STRK are likely to draw the most trader attention given their scale and visibility.

Looking Ahead

Investors and traders may monitor project communications and liquidity conditions around the unlock windows. Position sizing, hedging strategies, and awareness of vesting calendars can be prudent in navigating potential volatility as these unlocks take effect next week.