Lead

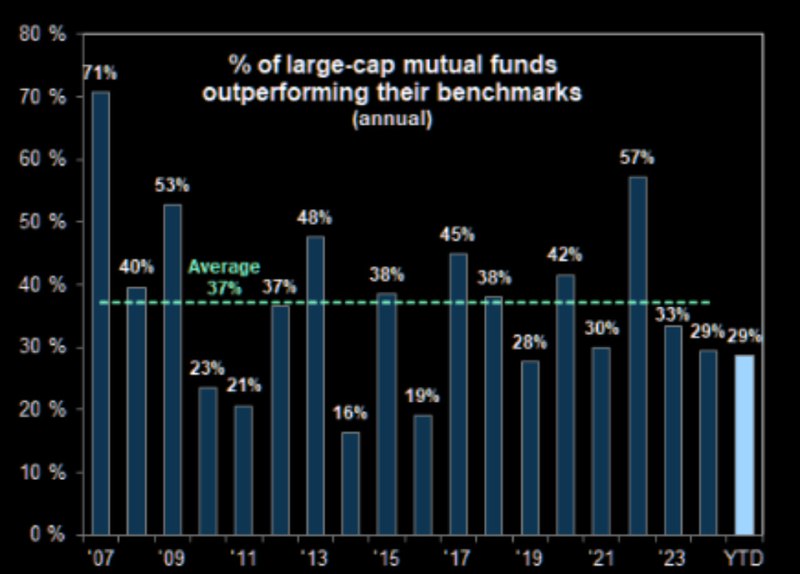

Only 29% of large-cap mutual funds outperformed their benchmarks in 2023 year-to-date, falling below the long-run average of 37%. The data underscores persistent headwinds for active managers, with historic extremes ranging from 71% in 2007 to just 16% in 2014.

Key Developments

- 2023 YTD outperformance: 29% of large-cap mutual funds beat their benchmarks

- Long-run average: 37%

- Historical high: 71% in 2007

- Historical low: 16% in 2014

A year-to-date reading of 29% indicates that a clear majority of actively managed large-cap funds trailed their respective benchmarks in 2023. This continues a long-standing challenge for active strategies, particularly in environments where broad market indices lead.

Context and Implications

The outperformance rate remains below the historical average, highlighting the difficulty of consistently beating benchmarks after costs and in highly competitive, information-rich large-cap markets. While the data is historical through 2023 YTD, the pattern is notable for:

- Asset allocators assessing the active vs. passive mix in portfolios

- Investors evaluating fee-sensitive strategies and risk-adjusted returns

- Ongoing debates around market concentration and the role of mega-cap equities

The figures reinforce the structural challenge facing active management in large-cap equities, where benchmark dominance and cost efficiency can tilt outcomes toward passive strategies.

Looking Ahead

With the 2023 YTD figure sitting below the 37% long-term average, investors will be watching whether full-year results and subsequent years show a reversal or continued underperformance among active large-cap funds. Allocation decisions may increasingly favor passive vehicles when persistent underperformance persists, though market dispersion and volatility could periodically reset the opportunity set for stock pickers.