Lead

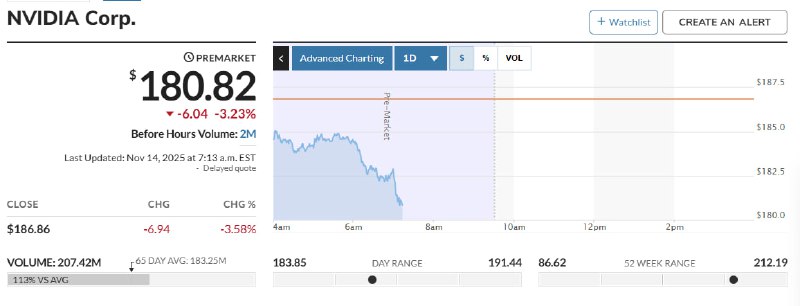

Nvidia shares traded lower in premarket action, falling to $180.82—down $6.04 (-3.23%) from the prior close of $186.86. Early trading showed approximately 2 million shares changing hands before the bell, with the move poised to influence broader risk appetite across tech and potentially AI-linked crypto assets.

Key Developments

- Premarket price: $180.82

- Change: -$6.04 (-3.23%)

- Previous close: $186.86

- Before-hours volume: ~2 million shares

- Prior session range displayed: $183.85 – $187.50

- Recent session volume shown: 207.24 million shares

Nvidia remains a central barometer for AI-driven market sentiment due to its dominant position in accelerated computing and data center GPUs. A notable premarket decline in the stock often reverberates through growth-tech names and can feed into risk trends that sometimes touch AI-related crypto tokens and GPU-centric mining narratives.

Market Impact

- A pullback in Nvidia can signal a broader risk-off tone in high-beta tech, with traders monitoring spillover to speculative corners of the market.

- In digital assets, sentiment around AI-focused tokens and coins tied to compute or GPU themes can be sensitive to shifts in Nvidia’s outlook, though direct correlations vary over time.

While crypto and equities do not move in lockstep, Nvidia’s premarket weakness may add a cautious undertone to AI-linked digital assets as markets open.

Looking Ahead

Market participants will watch whether Nvidia stabilizes after the opening bell and how flows in AI-heavy tech indices develop. Any sustained pressure could weigh on risk sentiment into the session, while a rebound might ease concerns across both equities and AI-themed crypto segments.