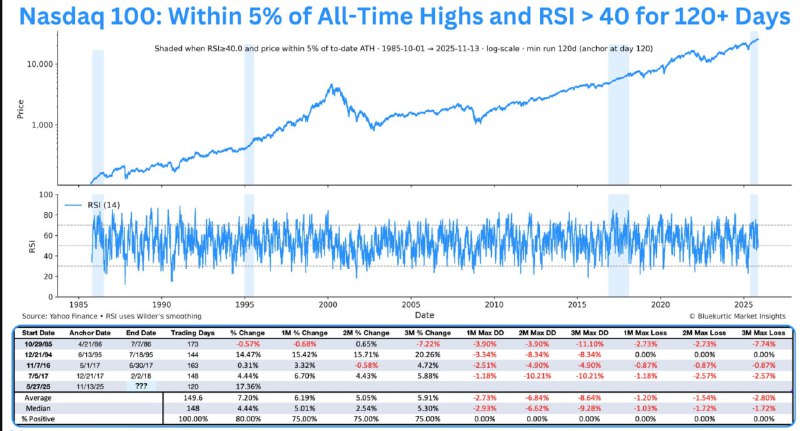

The Nasdaq 100 has remained within 5% of its all-time high for more than 120 consecutive days while the Relative Strength Index (RSI) stays above 40—only the fifth such instance on record. The current stretch has lasted at least 148 days. Historically, the following three months saw limited average peak losses but meaningful maximum drawdowns.

Key Developments

- Rare momentum setup: This is just the fifth time the Nasdaq 100 has held within 5% of its ATH for 120+ days while RSI > 40.

- Endurance: The ongoing sequence has already persisted for at least 148 days.

- Subsequent risk profile: Over the next three months following similar setups, the market recorded an average peak loss of 2.8% and an average maximum drawdown of 8.6%.

Market Context

A long period with the index near record highs and RSI above 40 typically reflects sustained positive momentum. In historical analysis spanning roughly 1985–2023, these regimes were rare but notable for maintaining elevated prices before eventually encountering pullbacks.

- The RSI is a momentum indicator; readings above 40 are often associated with a bullish or neutral-bullish trend backdrop.

- “Within 5% of ATH” indicates persistent proximity to record levels—an expression of resilience despite intermittent volatility.

What It Means for Crypto

While digital assets have their own drivers, broader risk sentiment in equities—especially large-cap tech represented by the Nasdaq 100—often influences crypto market behavior.

- Persistent strength in growth equities can support risk appetite that may spill over into Bitcoin, Ethereum, and major altcoins.

- However, the historical pattern of modest average peak losses and deeper potential drawdowns underscores that momentum phases can still encounter volatility, a dynamic that crypto markets may mirror or amplify.

Looking Ahead

Investors will watch whether this momentum regime persists or gives way to consolidation. Key catalysts include macroeconomic data, earnings from major tech constituents, and liquidity conditions. For crypto participants, shifts in risk sentiment stemming from equity markets could shape near-term volatility and trend direction.

As with any historical analysis, past patterns do not guarantee future outcomes. Risk management remains essential across both equity and crypto portfolios.