Lead

MicroStrategy has reallocated 43,415 BTC—worth approximately $4.26 billion—across more than 100 new custodian addresses as part of a planned wallet reorganization. Blockchain data from Arkham Intelligence indicates the transfers are routine and not indicative of asset liquidation.

Key Developments

- Amount moved: 43,415 BTC

- Estimated value: ~$4.26 billion

- Destination spread: 100+ new custodian addresses

- Purpose: Planned, periodic wallet reorganization for custody and security

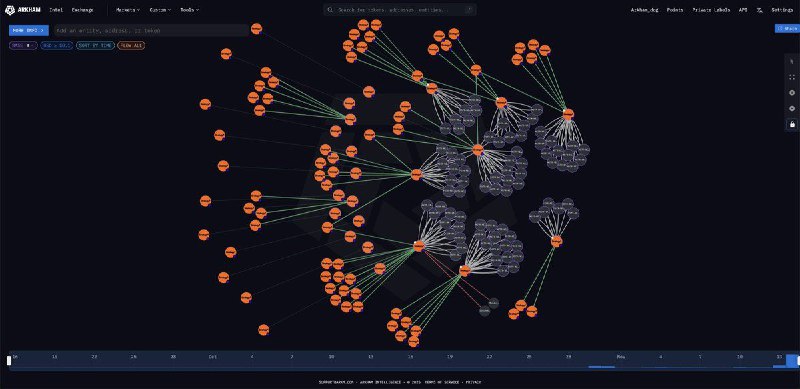

Arkham’s on-chain visualization shows a hub-and-spoke pattern typical of large custodial reshuffles, with funds dispersing from primary wallets to a broad set of newly created addresses. Such operational movements are common among institutional holders to enhance security, rotate addresses, and optimize custody workflows.

Context and Significance

MicroStrategy is one of the largest corporate holders of Bitcoin, and its treasury operations are closely monitored by market participants. Large internal transfers can sometimes be misread as selling pressure; however, the structure and destination of these transactions—toward custodian-managed addresses—point to internal reorganization rather than disposals.

While eye-catching in size, the flows align with standard wallet hygiene and custodial best practices, including address rotation, access control updates, and UTXO management.

For transparency, blockchain analytics platforms such as Arkham Intelligence routinely map and label entity-linked wallets, helping distinguish internal movements from market sales.

Market Impact

- No immediate evidence suggests these transfers impacted exchange balances or spot market liquidity.

- Investors tracking on-chain flows should differentiate custodial reshuffles from transfers to exchanges, which can signal potential selling.

Conclusion

MicroStrategy’s redistribution of 43,415 BTC underscores ongoing institutional-grade custody practices. As on-chain oversight grows more sophisticated, clear identification of internal treasury operations helps reduce false market signals and supports better-informed investor decisions.