Lead

Mastercard is partnering with Gemini and Ripple to pilot credit card settlement using Ripple’s RLUSD stablecoin on the XRP Ledger (XRPL). WebBank, the issuer of Gemini’s credit card, is participating. If implemented, it would be among the first instances of a regulated U.S. bank settling traditional card transactions with a stablecoin on a public blockchain.

Key Developments

- Mastercard x Gemini x Ripple pilot: The initiative will test RLUSD-based settlement flows on

XRPLfor card transactions. - Bank participation: WebBank—the regulated issuer of the Gemini credit card—will take part in the pilot, marking a significant step toward bank-grade blockchain settlement.

- Stablecoin growth: The market capitalization of RLUSD has surpassed $1 billion, underscoring rising demand for regulated stablecoin infrastructure.

- Ripple funding: Ripple recently secured $500 million in strategic investment at a $40 billion valuation, with participation from leading funds, bolstering its payments and stablecoin roadmap.

The pilot positions stablecoins for mainstream card settlement and could accelerate financial institutions’ use of public blockchains for regulated payments.

Market Snapshot

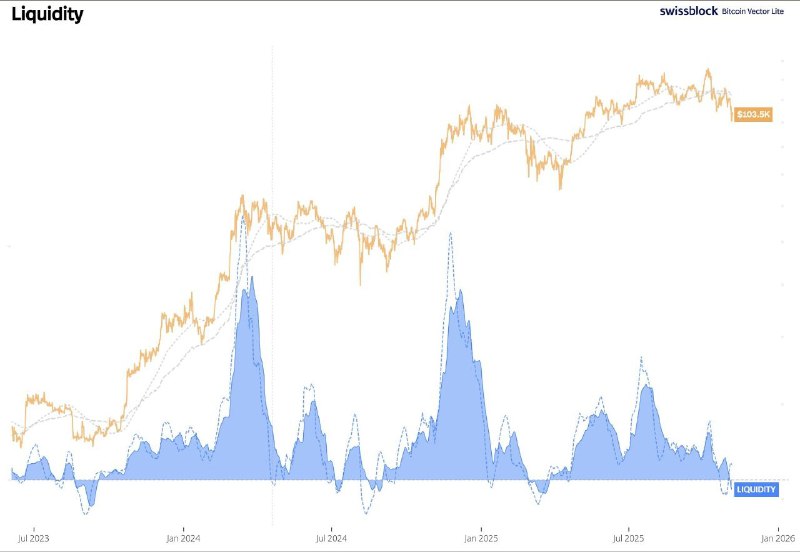

- Bitcoin (BTC) traded above $103,000, as some market observers noted signs of improving liquidity.

- Zcash (ZEC) broke above $500, its highest level since 2018.

- Research indicated Ether (ETH) futures open interest fell by 16% over the past 24 hours.

- Justin Sun staked 45,000 ETH (about $154.5 million) on Lido, signaling continued demand for liquid staking.

Top 24-hour gainers

- ICP — $5.97 (↑20.23%)

- Quant (QNT) — $86.74 (↑18.41%)

- Zcash (ZEC) — $515 (↑18.32%)

Why It Matters

Mastercard’s pilot with Gemini and Ripple highlights growing institutional adoption of blockchain-based settlement. Using RLUSD on XRPL for card transactions may reduce friction and potentially improve settlement speed and transparency, while maintaining compliance through participation by a regulated U.S. bank.

Outlook

If successful, the program could pave the way for broader stablecoin settlement in card networks and traditional banking. With RLUSD’s rising capitalization and Ripple’s fresh funding, further expansion across payment rails and new use cases on XRPL bears watching.