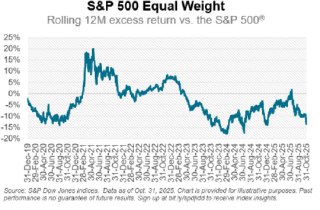

U.S. blue chips continued to outpace the broader market as smaller companies fell behind. The S&P 500 Equal Weight index’s 12-month rolling performance versus the cap-weighted S&P 500 dropped from +2% in early July to -13% as of last Friday. Meanwhile, the S&P MidCap 400 and S&P SmallCap 600 ended last month lower.

The widening gap highlights increasingly narrow market breadth, with gains concentrated among the largest constituents of the benchmark. The equal-weighted index, which assigns the same weight to each S&P 500 stock, is often used to gauge participation across the market. Its underperformance relative to the cap-weighted S&P 500 signals that fewer stocks are driving index returns.

Mid- and small-cap weakness underscores ongoing caution toward economically sensitive and domestically focused companies. While large-cap leaders have buoyed headline indices, lagging breadth can leave markets more vulnerable if leadership stumbles.

Why it matters:

- Narrow leadership increases reliance on a handful of mega-cap stocks

- Persistent underperformance in equal-weighted, mid-cap, and small-cap indices points to limited participation

- Investors often watch breadth indicators to assess the durability of rallies

What to watch:

- Whether breadth improves, with equal-weighted and smaller-cap indices stabilizing or rebounding

- Earnings dispersion and guidance across mid- and small-cap segments

- Shifts in risk appetite that could broaden participation across sectors and market caps

Conclusion If breadth fails to recover, the market’s advance may remain concentrated and more fragile. A sustained pickup in mid- and small-cap performance would signal a healthier, more durable equity rally.