Lead

Tokenized U.S. equities on Ethereum—particularly the Magnificent 7 issued by Ondo Finance—are among the fastest-growing real-world assets (RWA) on-chain. Over the past 30 days, several tokenized stocks posted triple-digit growth, while USDT remained the largest asset by market capitalization with minimal change.

Key Developments

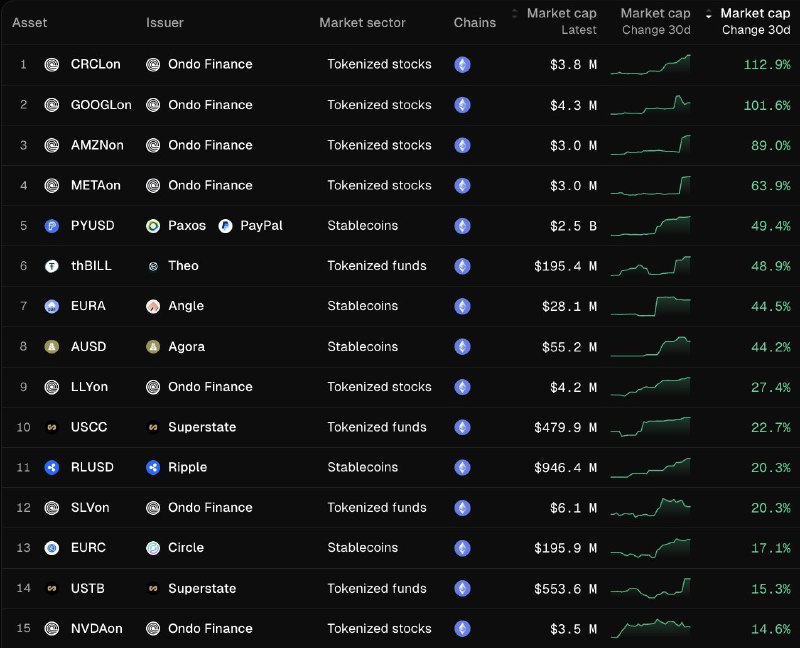

Data on tokenized assets indicates rising demand for on-chain exposure to large-cap U.S. tech stocks:

- The fastest-growing RWA segment on Ethereum comprises Magnificent 7 stocks tokenized by Ondo Finance.

- CRCLon led 30-day growth with a +104.6% increase.

- GOOGLon (tokenized Alphabet) rose +101.6% over 30 days.

- AMZNon (tokenized Amazon) gained +95.8%.

- METAon (tokenized Meta) advanced +41.2%.

- PAYUSD increased +49.4% over the same period.

- USDT showed a modest +0.1% 30-day change but retained the largest market capitalization at $82.9 million.

Market Context

The latest figures underscore accelerating momentum for tokenized RWAs on Ethereum, with tokenized stocks and stablecoins leading activity. The strong performance of Magnificent 7 proxies suggests growing investor interest in on-chain exposure to blue-chip U.S. equities, as tokenization blends traditional finance with decentralized infrastructure.

RWA growth has become a key narrative for Ethereum, where regulated issuers and protocols are expanding offerings that mirror familiar financial instruments—equities, treasuries, and stablecoins—while benefiting from blockchain transparency and settlement efficiency.

Why It Matters

- Tokenized equities with recognizable brands may be lowering the barrier for TradFi participants to experiment with DeFi rails.

- Stablecoins remain the liquidity backbone, with USDT maintaining a dominant market cap despite minimal monthly movement.

- The outperformance of equities like GOOGLon and AMZNon highlights demand for tokenized exposure to the tech sector.

Looking Ahead

If liquidity and regulatory clarity continue to improve, tokenized blue-chip equities and stablecoins could see broader adoption across DeFi venues, with Ethereum likely to remain a primary settlement layer for RWAs.