Key Developments

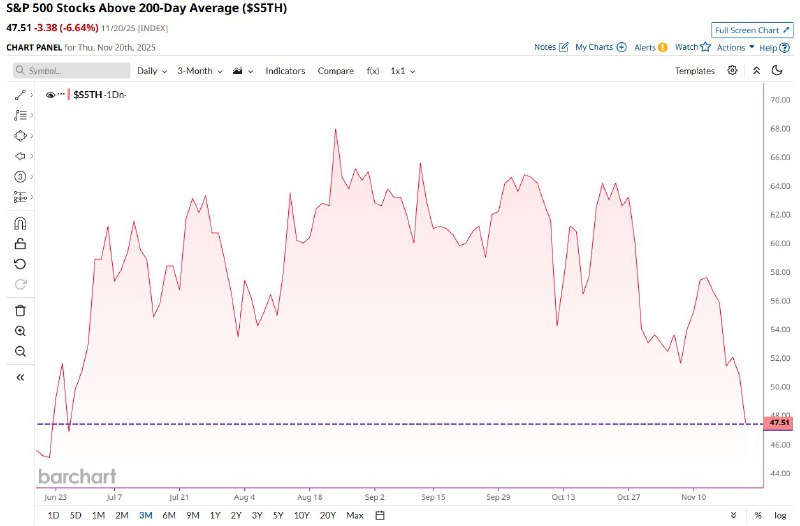

Market breadth in U.S. equities weakened notably, with less than half of S&P 500 constituents trading above their 200-day moving average. The breadth gauge often referenced as $S5TH stood at 47.51 on November 29, 2023, down 3.38 points (a 6.64% decline) from the prior reading.

- Indicator: S&P 500 stocks above 200-day average (

$S5TH) - Latest reading: 47.51

- Change: -3.38 points (-6.64%)

- Timeframe visible on the chart: Nov 2022 – Nov 2023

- Noted pattern: A generally declining trend with notable dips around May and October

- Significance: This marks the weakest market breadth since June

Why It Matters

The 200-day moving average is a widely followed long-term trend indicator. When fewer than 50% of index members trade above it, breadth is considered weak, suggesting narrow leadership and potentially fragile risk sentiment. For crypto markets—often correlated with broader risk assets—deteriorating equity breadth can foreshadow heightened volatility and selective risk-taking.

Market Context

- A drop below the 50% threshold indicates that gains may be concentrated in fewer large-cap names, while a larger share of stocks lag longer-term trends.

- Breadth weakness can precede equity drawdowns or periods of choppy trading, especially if macro headwinds persist.

- For digital assets, periods of risk aversion in equities have historically coincided with cautious flows into Bitcoin and altcoins, though correlations can vary over time.

Looking Ahead

Investors will watch for a recovery in breadth as a sign of healthier, broad-based participation in rallies. Key drivers include macro data, interest rate expectations, and earnings guidance. A sustained improvement could bolster risk appetite across equities and crypto, while further deterioration may keep traders defensive.