Lead

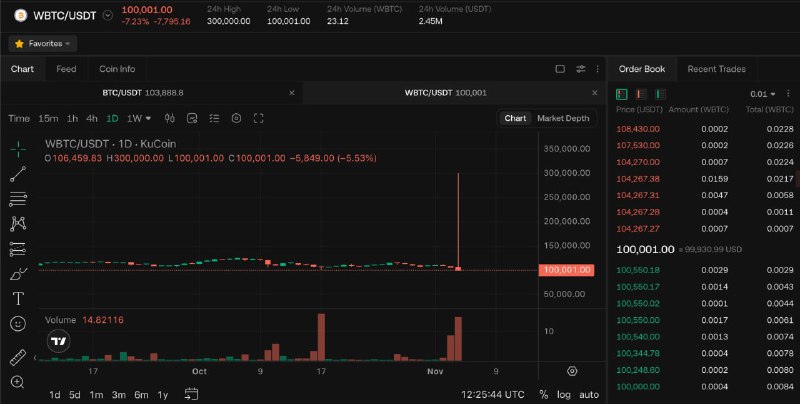

Wrapped Bitcoin (WBTC) on KuCoin briefly showed extreme price anomalies, with on-screen readings indicating a spike to as high as $300,000 before rapidly correcting. Traders widely attributed the move to a technical bug after the interface displayed unusual metrics, including a 24h high of $100,001, a 24h low of $100, and a daily change of -85.15%.

Key Developments

- The

WBTC/USDTpair on KuCoin exhibited outlier prints suggesting an intraday surge to $300,000, far above WBTC’s typical parity with Bitcoin. - Screens from the trading interface showed:

- Current price at one point of $100,001.00

- 24h high: $100,001.00

- 24h low: $100.00

- 24h volume: 2.45M (units shown in the interface)

- A displayed price change of -714,387.00 (-85.15%)

- The anomalies were visible on the 1D timeframe, underscoring a likely data or order-book malfunction rather than a broad market move.

Context and Possible Causes

WBTC is a tokenized representation of Bitcoin on Ethereum, designed to track BTC at 1:1. Large deviations from Bitcoin’s spot price generally point to technical or market structure issues rather than fundamentals. Common drivers of such prints on exchanges can include:

- Data feed/API errors or desynchronization

- Fat-finger orders or mispriced limit orders

- Thin liquidity pockets causing rapid order book gaps

- Temporary display or calculation bugs in the trading UI

While the exact cause was not immediately clear, the combination of a $300,000 top tick, a $100 intraday low, and an -85.15% daily change strongly suggests a transient technical glitch.

Market Impact

- It remains unclear whether significant volumes executed at the extreme levels or if trades were subsequently adjusted. The interface indicated 2.45M in 24-hour volume, but that figure alone does not confirm fills at the anomalous prices.

- Events like this can trigger cascading stop orders or liquidations in illiquid books, though such impacts are typically limited if rooted in a display or feed error.

Why It Matters

- Price integrity on centralized exchanges is critical for trader confidence and risk management. Even brief glitches can lead to unintended order executions or misleading signals for algorithmic strategies.

- The incident is a reminder to use limit orders, verify prices across multiple sources, and maintain alert thresholds—especially when trading pairs that may have lower liquidity.

Looking Ahead

Traders will watch for any post-incident clarifications and safeguards to prevent similar anomalies. The episode underscores the importance of robust data feeds and exchange-level circuit checks to maintain orderly trading.