Lead

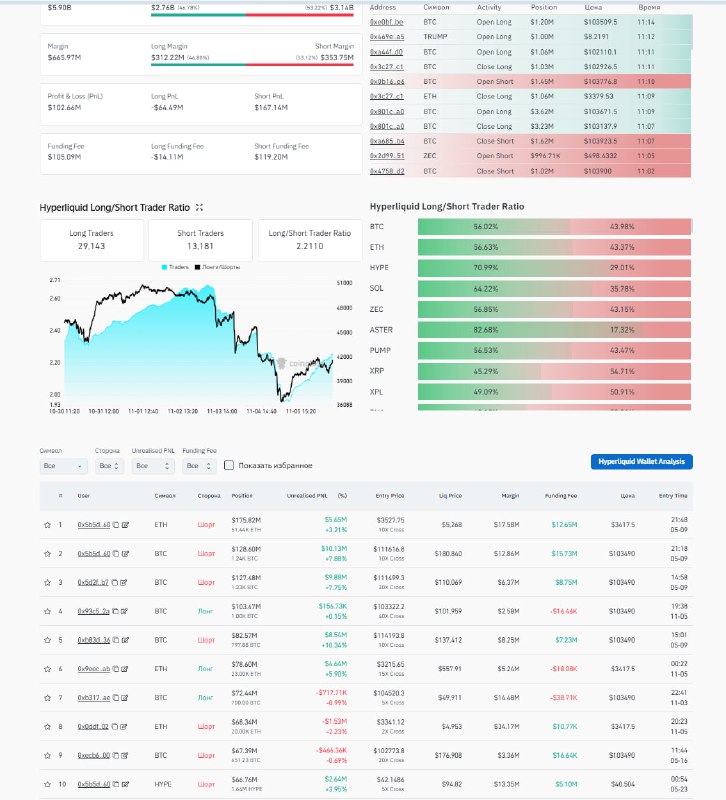

A single large ZEC perpetual position on the Hyperliquid derivatives exchange is showing an unrealized loss of approximately $10.8 million. At the same time, BitMEX co-founder Arthur Hayes has taken a long position in ZEC (Zcash) again, setting a bullish price target of $1,000. Market positioning data on Hyperliquid shows mixed sentiment across assets.

Key Developments

- A large ZEC perp position on Hyperliquid is in an unrealized loss of about $10.8M.

- Arthur Hayes is long ZEC with a bullish target of $1,000.

- Hyperliquid’s overall long/short trader ratio is around 2.21, indicating long dominance.

- Among the platform’s top 10 positions by count, shorts reportedly account for 70%, with longs at 30%.

Derivatives Positioning Snapshot

- Overall Hyperliquid long/short ratio: ~2.21 (more longs than shorts)

- Visible trader ratio by asset:

- BTC: 49.56% Long

- ETH: 56.62% Long

- LINK: 62.42% Long

These metrics highlight a divergence between broader trader sentiment (long-biased) and the composition of the largest positions (short-heavy) on the exchange.

Market Snapshot

- Bitcoin (BTC) traded near $27,224, with a 24-hour close around $26,602.

- Ethereum (ETH) hovered near $1,593.

- 24-hour changes: ETH -0.83%, BTC 0.00%, LINK +0.29%.

Funding and margin indicators across the board suggest a cautious stance, with positioning varying by asset and size of participants.

What to Watch

- Potential liquidation or risk adjustments tied to the large ZEC perp loss.

- Whether Arthur Hayes’s renewed long thesis on ZEC catalyzes sentiment or price action toward his $1,000 target.

- Shifts between retail-dominant long positioning and top-trader short exposure on Hyperliquid.

Conclusion

Derivatives data on Hyperliquid points to a complex backdrop for ZEC, with a massive losing position, a high-profile long call from Arthur Hayes, and mixed positioning signals across the platform. Traders will be watching ZEC’s order flow and funding dynamics closely for signs of a sentiment break.