Lead

A large trader on the decentralized derivatives exchange Hyperliquid deposited $5 million USDC and bought 35,335 SOL for roughly $5.04 million at $143 per token. The same account is running a highly leveraged 20x long on Bitcoin valued at about $29 million (approximately 300 BTC). Over the last 24 hours, 174,020 traders were liquidated across the market, totaling $671.51 million, with the largest single liquidation a $7.40 million BTC-USD position on Hyperliquid.

Key Developments

- A whale account funded with $5M USDC executed a $5.04M purchase of 35,335 SOL at $143 on Hyperliquid.

- The same wallet is holding a 20x leveraged BTC long worth around $29M (about 300 BTC notional).

- Account metrics displayed a total value near $28.93M, a fully long directional bias (100%), and a cumulative P&L of -$5.96M, indicating recent drawdowns despite the large positions.

Derivatives Heatmap

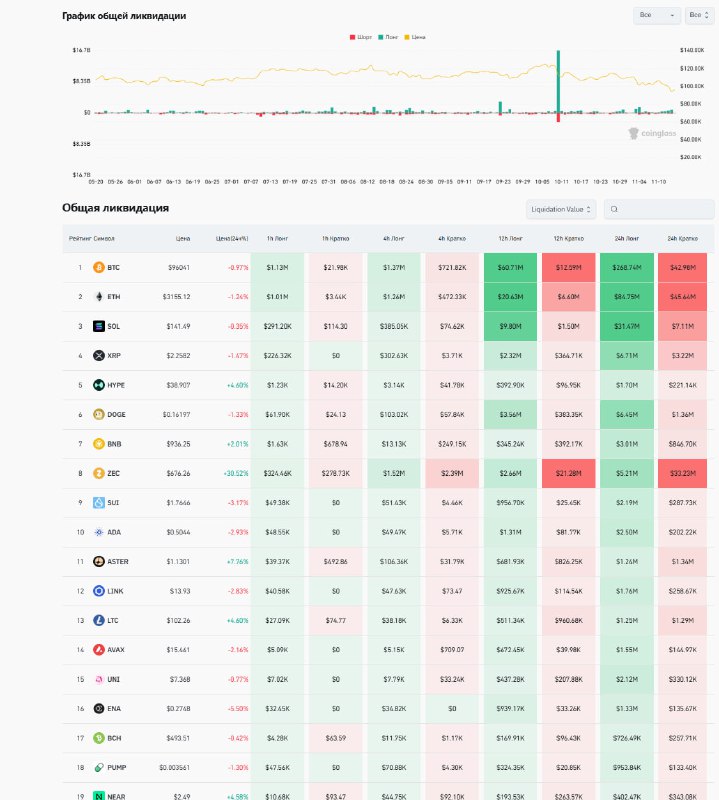

- In the past 24 hours, 174,020 traders were liquidated, with combined losses reaching $671.51M.

- The single largest liquidation recorded was a $7.40M BTC-USD position on Hyperliquid.

- BTC and ETH each saw around $59M in liquidations, with data showing a notable spike in activity around 23:00.

Market Positioning on Hyperliquid

- Among top traders on Hyperliquid, positioning by count skewed 60% short / 40% long, highlighting mixed sentiment despite the whale’s aggressive long exposure.

- The whale’s simultaneous SOL accumulation and high-leverage BTC long underscores elevated risk tolerance in a market that just experienced broad liquidations.

Context and Implications

The combination of a large leveraged BTC position and substantial SOL spot buying on Hyperliquid comes as derivatives markets undergo heavy stress, evidenced by more than $671M in liquidations over 24 hours. With positioning still mixed among top traders, the market remains prone to sharp moves that could amplify further liquidations or fuel short squeezes.

Conclusion

A well-capitalized trader is making bold bets on Bitcoin and Solana via Hyperliquid amid elevated volatility and mass liquidations. Market participants will be watching whether this leverage adds momentum to the next directional move—or faces further stress if volatility persists.