Lead

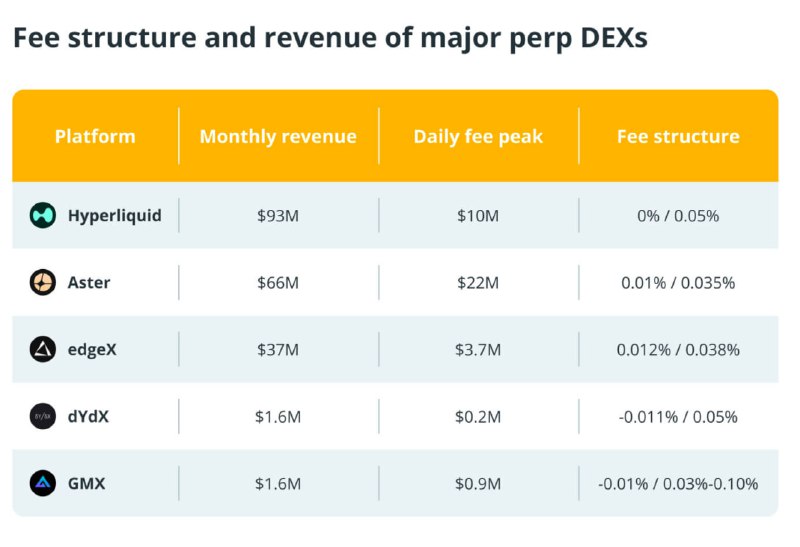

Perpetual DEX competition is intensifying as Hyperliquid reportedly generated over $117 million in fees in October, with the platform returning the entire amount to HYPE holders through buybacks. Comparative market data shows Hyperliquid leading monthly revenues among major perpetual exchanges, while rivals like Aster, dYdX, edgeX, and GMX show varying fee peaks and strategies.

Key Developments

- Full fee return via buybacks: Hyperliquid's stated policy of returning all fees to HYPE holders through buybacks distinguishes it from competitors that do not fully redistribute fees.

- Monthly revenue snapshot (comparative):

- Hyperliquid: $93M

- Aster: $66M

- edgeX: $37M

- dYdX: $6.1M

- GMX: $4.2M

- Daily fee peak (comparative):

- Aster: $22M

- Hyperliquid: $10M

- edgeX: $3.7M

- dYdX: $0.9M

- GMX: $0.9M

The figures underscore two dynamics: sustained monthly fee leadership by Hyperliquid, and sharp single-day spikes at Aster. The data also highlights the widening gap between newer high-velocity perp DEXs and earlier-generation platforms.

Context: Performance vs. Profit Sharing

The central question for perpetual DEX growth is whether platforms win users primarily through superior performance—such as deeper liquidity, lower latency, and robust risk engines—or through profit distribution mechanisms like tokenized fee sharing and buybacks.

- Hyperliquid’s approach leans into direct value accrual for token holders via recurring buybacks funded by trading fees.

- Competitors such as dYdX and GMX employ different revenue and incentive structures, while Aster and edgeX have shown strong fee generation but do not mirror Hyperliquid’s full-fee buyback model.

Market Impact

- For traders: Elevated fee throughput and liquidity on leading perp DEXs can translate into tighter spreads and deeper markets.

- For token holders: Programmatic buybacks and revenue sharing may increase perceived value capture, though sustainability depends on trading volumes and market conditions.

- For the sector: The fee race and divergence in tokenomics are likely to push platforms toward clearer value propositions—either pure performance or explicit revenue distribution.

Looking Ahead

Investors and traders will be watching whether Hyperliquid can maintain its fee leadership while sustaining full-fee buybacks, and whether rivals intensify their own revenue-share programs. Continued growth in derivatives volumes could amplify these competitive dynamics across the perp DEX landscape.