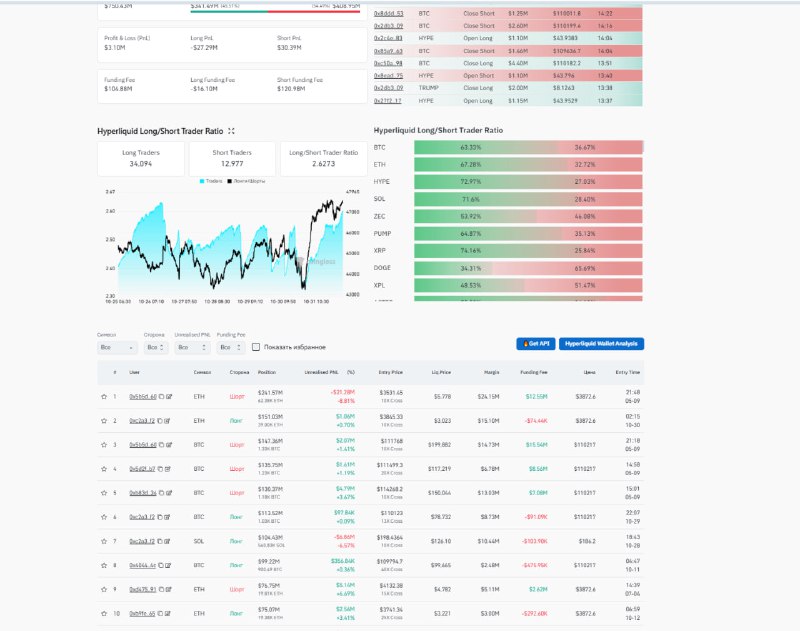

Hyperliquid, a decentralized derivatives exchange, currently shows an even split between long and short positions—50/50—among the top 10 by count. The balanced distribution suggests neutral market sentiment across leading markets on the platform.

The long–short ratio by number of positions can offer a quick snapshot of trader positioning. A 50/50 split indicates neither buyers nor sellers hold a numerical advantage among the most active markets. While this balance points to equilibrium, it does not reflect position size, open interest, or leverage, which can materially alter risk dynamics.

On derivatives venues like Hyperliquid, traders often monitor multiple indicators—such as open interest, funding rates, and liquidation levels—alongside the long–short ratio to assess momentum and potential volatility. A sudden shift away from a 50/50 split, or a divergence between position count and position size, can signal changing sentiment in perpetual futures markets.

Hyperliquid continues to attract activity in decentralized perpetuals, where on-chain visibility and non-custodial trading appeal to users seeking transparent market structure.

Conclusion: An evenly balanced long–short ratio among the top 10 positions by count reflects a neutral stance on Hyperliquid. Traders may watch for swift changes in this distribution and corroborate with open interest and funding data to gauge the next directional move.