Lead

The S&P 500’s one-month put-call skew indicates below-average bearish positioning, suggesting a moderate tailwind for the index, according to Goldman Sachs. While supportive for equities, current sentiment is well short of the extreme fear that marked a clear buy signal in April.

Key Developments

- Positioning at 3/10: Goldman Sachs assesses current options positioning at 3 out of 10 versus the last three years, indicating a bearish tilt that is lighter than average.

- Moderate support, not capitulation: The metric implies a constructive backdrop for the SPX, but not the type of panic that has historically preceded stronger rebounds.

“At present the put-call skew suggests positioning is 3 out of 10 (i.e., below average) relative to the last three years. This implies a moderate tailwind for SPX going forward, but it is far from the extreme level of fear that was a clear buy signal in April,” Goldman Sachs noted.

Data Highlights

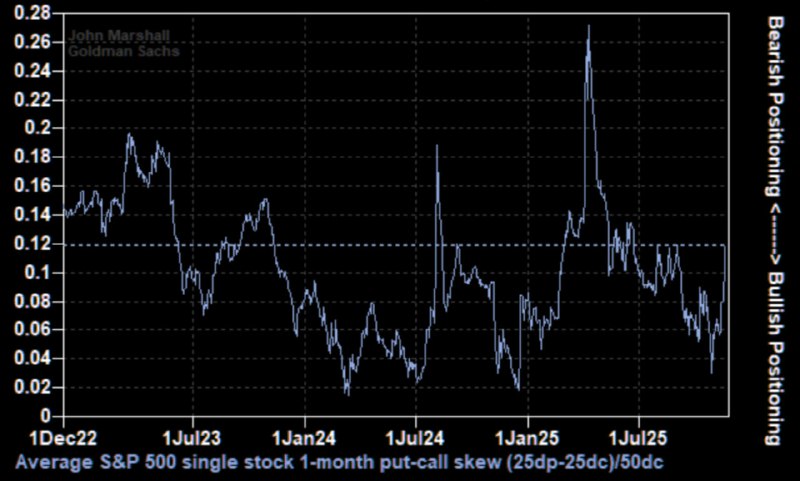

Goldman’s chart of the S&P 500 single-stock one-month put-call skew (credited to John Marshall) shows:

- The skew oscillating around zero from December 2022 through July 2025

- Peaks near February 2023 and March 2025 around 0.28

- Troughs around July 2023 and July 2024, dipping below -0.04

- An axis labeled “Bearish Positioning <----> Bullish Positioning,” underscoring how skew direction reflects investor hedging appetites

In options markets, a higher put-call skew typically signals increased demand for protective puts (greater caution), while a lower or negative skew can indicate reduced fear or relatively more interest in upside exposure.

Market Impact

- The current 3/10 reading points to a market that is cautious but not distressed, historically a benign backdrop for equities.

- The absence of extreme fear suggests less asymmetry to the upside than during capitulation phases, but still a constructive setup for near-term performance.

- For broader risk assets, including growth equities and other beta-sensitive segments, a moderately supportive skew often aligns with steadier risk appetite.

Outlook

If the skew remains near current levels, Goldman Sachs’ framework implies a gradual tailwind for the S&P 500 rather than a sharp, fear-driven rebound. Traders will watch whether positioning drifts toward extremes—either renewed fear (potentially more bullish from a contrarian standpoint) or complacency (which could temper upside). In the meantime, options markets are signaling measured risk appetite rather than stress.