Lead

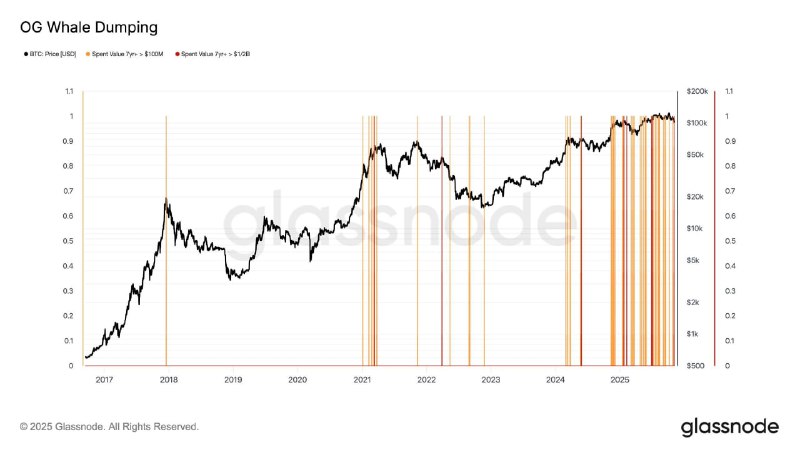

On-chain analytics indicate that long-standing "OG" Bitcoin holders have stepped up spending activity in 2025, signaling potential distribution by large wallets. Glassnode’s Spent Volume Age Bands suggest an uptick in older BTC moving on-chain, echoing patterns seen during prior cycle inflection points.

Key Developments

- Increased movement of older, long-dormant BTC implies reduced dormancy among OG holders

- The behavior aligns with historical episodes of whale distribution observed around major market turning points in 2021–2023

- Elevated spending from older cohorts can add supply-side pressure if demand softens

What the Data Shows

Glassnode’s visualization of "OG whale dumping" highlights periods when coins held for extended durations are spent and re-enter circulation. The Spent Volume Age Bands (SVAB) metric captures how much BTC is spent within specified coin-age cohorts, making it a useful proxy for tracking whether long-term holders are distributing or continuing to hold.

In 2025, SVAB activity appears elevated for older bands, indicating that more long-held coins are being moved. Historically, similar increases in older-cohort spending have occurred near major cycle transitions—both during late-stage rallies and during periods of market stress when investors de-risk.

Why It Matters

- Supply dynamics: When large, long-term holders reduce dormancy and spend coins, circulating supply can increase, potentially weighing on price if spot demand is insufficient.

- Market signaling: Rising SVAB from older cohorts has previously coincided with distribution phases, offering a contextual signal rather than a deterministic price forecast.

- Risk management: Traders and investors often track these shifts to gauge whether market strength is driven by new demand or met by long-term holder distribution.

Market Impact and Outlook

While increased spending by OG whales can introduce headwinds, market impact depends on offsetting demand, including accumulation by other cohorts and institutional flows. In past cycles, markets have absorbed distribution when broader risk appetite and liquidity were strong.

Participants will be watching whether:

- Elevated SVAB readings persist or normalize

- Exchange balances rise (suggesting sell-side intent) or fall (implying self-custody/accumulation)

- Long-term holder supply and dormancy metrics continue to decline

Conclusion

Glassnode’s on-chain indicators show that 2025 has brought a tangible pickup in spending from OG Bitcoin holders, consistent with prior distribution phases. While not a definitive bearish signal on its own, the shift underscores the importance of monitoring older-cohort activity, exchange balances, and demand strength to assess supply absorption in the months ahead.