FTX creditors may ultimately recover far less than headline figures suggest, with real compensation ranging from 9% to 46% and potentially lower due to high cryptocurrency prices, according to creditor group representative Sunil Kavuri. He added that even creditors assigned a 146% payout rate will not be fully made whole.

Kavuri said some projects may issue separate distributions to FTX creditors—such as airdrops—outside the formal bankruptcy process, offering incremental relief. At the same time, he warned of hostile actors seeking to undermine creditor interests. “Some have made it clear they want to harm FTX creditors, possibly funded by unscrupulous parties,” he said.

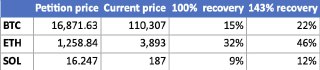

Creditors have long argued that recoveries are constrained by the bankruptcy framework, which typically values claims in U.S. dollars as of the petition date. With crypto markets significantly higher today than at the time of FTX’s collapse in November 2022, the gap between fiat-valued claims and current asset prices has become a focal point of frustration for many customers.

While any additional distributions or project-led airdrops could modestly improve outcomes for some creditors, Kavuri’s comments underscore ongoing concerns that published payout rates may not reflect the economic reality of losses—especially for those whose balances were primarily in crypto assets.

Looking ahead, creditors will be watching for any updates on potential supplemental distributions, as well as measures to address alleged bad-faith attempts to disrupt recovery efforts.