Lead

Digital asset investment products recorded a second straight week of withdrawals, with total outflows hitting $1.17 billion amid volatility from a recent liquidation cascade and uncertainty over potential U.S. rate cuts. Bitcoin and Ethereum led redemptions, while Solana stood out with sustained inflows.

Key Developments

- Total outflows from digital asset products: $1.17 billion over the past week.

- Breakdown across products: Bitcoin outflows of $932 million and Ethereum outflows of $438 million were reported across investment vehicles.

- Altcoins proved more resilient, with Solana (SOL) drawing $118 million in new capital last week and $2.1 billion over the last nine weeks.

Market participants cited lingering volatility following a cascade of liquidations and ongoing uncertainty around the timing and scale of potential U.S. interest rate cuts as key drivers of the risk-off positioning.

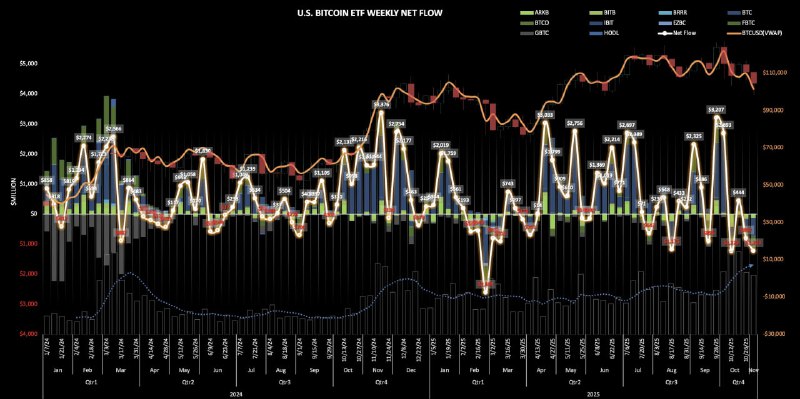

ETF Flow Breakdown

Separate figures for U.S. spot ETF flows underscore the risk aversion:

Bitcoin spot ETFs (Week 44, Year 2 of trading)

- Net flow: - $1.223 billion (the second-largest weekly outflow since launch)

- Weekly trading volume: $28 billion

- Weekly high price: $101,615

- Issuer flows:

IBIT(iShares): - $596 millionFBTC(Fidelity): - $438 millionBITB(Bitwise): + $4.7 million

Ethereum spot ETFs (Week 44, Year 2 of trading)

- Net flow: - $517 million

- Weekly trading volume: $12 billion

- Weekly high price: $3,323

- Issuer flows:

- BlackRock: - $306 million

- Fidelity: - $109 million

- Grayscale: - $99 million

These ETF figures indicate concentrated institutional selling pressure during the week, even as some alternative issuers and assets saw limited inflows.

Market Context

Technical readings suggest oversold conditions in Bitcoin—commonly a setup for a short-term bounce—yet the scale of ETF redemptions and broader fund outflows point to caution among larger allocators.

- Recent liquidation-driven volatility has kept leverage in check and sentiment fragile.

- Macro uncertainty around U.S. rate-cut timing continues to weigh on risk assets, including cryptocurrencies.

Altcoins Standouts

Despite the broader pullback, Solana maintained momentum with a $118 million weekly inflow and $2.1 billion amassed over the past nine weeks, highlighting continued investor interest in high-throughput Layer-1 ecosystems.

Outlook

With ETF flows firmly in focus and macro catalysts on the horizon, markets may remain volatile. Traders will watch whether oversold signals translate into a sustainable rebound or if continued redemptions from spot ETFs keep pressure on Bitcoin and Ethereum. Meanwhile, persistent inflows into Solana could continue to differentiate its performance from large-cap peers.