Lead

Digital asset exchange-traded products (ETPs) recorded about $2 billion in net outflows last week amid monetary policy uncertainty and selling by large crypto-focused investors. The United States accounted for 97% of the withdrawals, while Germany saw modest inflows against the global trend.

Key Developments

- Total weekly outflows from crypto ETPs: $2.0 billion

- U.S. share of outflows: $1.97 billion (97%)

- Germany bucked the trend with $13.2 million in inflows

- Investors rotated into multi-asset ETPs (+$69 million) and increased short Bitcoin exposure

Asset Breakdown

- Bitcoin (BTC) led redemptions with $1.38 billion in outflows

- Ethereum (ETH) followed with $689 million in outflows

- Multi-asset ETPs attracted $69 million in inflows as investors diversified exposure

- Rising interest in short Bitcoin ETPs suggests growing hedging or bearish positioning

Regional Dynamics

- United States: Drove nearly all net outflows, reflecting heightened sensitivity to interest rate expectations and macro signals

- Germany: Registered $13.2 million in inflows, indicating select European demand despite broader market risk-off sentiment

Market Context

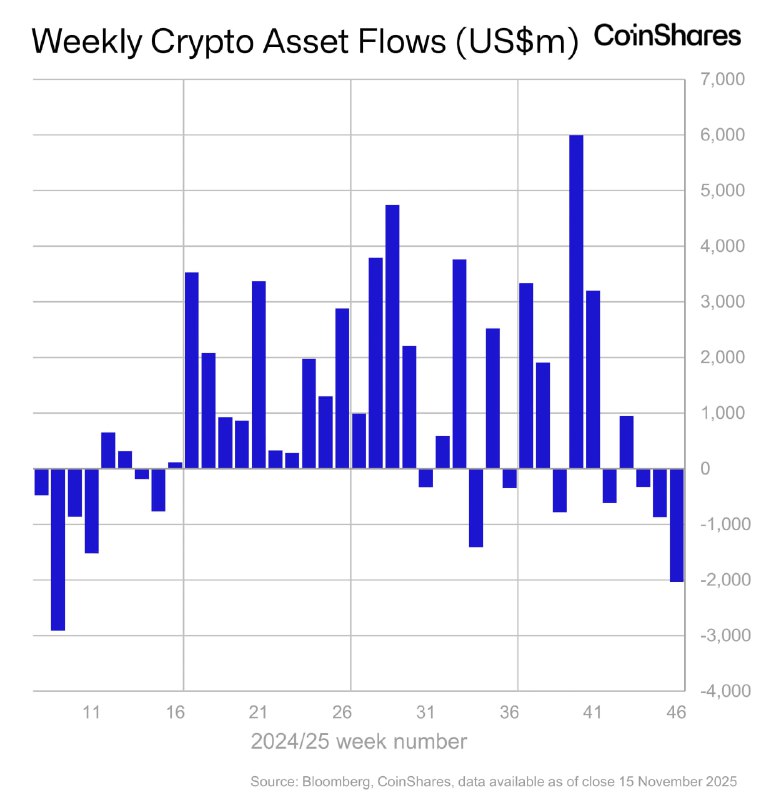

Weekly flow data, available as of 15 November 2025, shows one of the largest negative prints of the year, aligning with a notable spike in outflows during week 46 on the chart of "Weekly Crypto Asset Flows (US$m)". The backdrop includes:

- Ongoing monetary policy uncertainty, with markets reassessing the path of interest rates

- Profit-taking and de-risking by large crypto investors, particularly in U.S.-listed products

Why It Matters

- Heavy outflows from Bitcoin and Ethereum ETPs can pressure near-term liquidity and sentiment across spot markets

- The shift toward multi-asset funds implies a preference for diversification during volatility

- Increased short BTC positioning reflects caution and hedging into macro-sensitive catalysts

Outlook

Flows may remain choppy until there is clearer guidance on interest rates and macro conditions. Watch for:

- Changes in U.S. rate expectations and their impact on risk appetite

- Persistence of outflows from single-asset BTC/ETH ETPs versus stabilizing demand in diversified products

- Whether European inflows broaden beyond Germany in the coming weeks