Lead

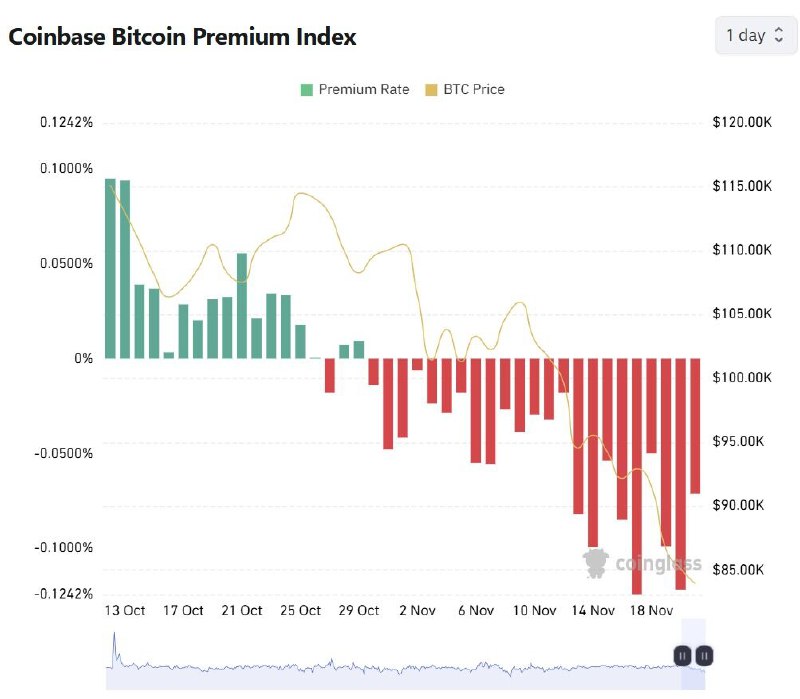

The Coinbase Bitcoin Premium Index has remained below zero since October 29, indicating U.S. spot market demand lagging offshore venues. Chart data shows the premium stayed negative into mid-November, even as BTC traded roughly between $85,000 and $120,000 during the period.

The index has not turned green since Oct. 29, underscoring persistent discounting on Coinbase relative to other major exchanges.

Key Developments

- The Coinbase Premium Index has been consistently negative from Oct. 29 through at least Nov. 18.

- The premium rate fluctuated in a narrow band, roughly between -0.1242% and 0.1242%.

- A notable dip appeared in mid-November, with values remaining below zero.

What the Coinbase Premium Index Measures

The Coinbase Premium Index, tracked by analytics platforms such as CoinGlass, reflects the price difference of BTC/USD on Coinbase versus other major exchanges.

- A positive (green) premium suggests stronger U.S. spot buying pressure, often associated with institutional activity.

- A negative premium indicates Coinbase prices are trading at a discount, implying comparatively weaker U.S. demand.

Market Context

- Charted data over a one-day interval shows BTC ranged approximately $85,000–$120,000 from mid-October to Nov. 18.

- Despite broad price strength within that range, the persistent negative premium signals U.S. spot buyers have not been leading the market.

- Such divergences are closely watched by traders as a sentiment gauge across U.S. vs. offshore liquidity.

Why It Matters

- The Coinbase Premium Index is used by market participants to assess regional demand imbalances.

- A sustained negative reading can indicate a cautious or lagging U.S. bid during rallies.

- Premiums can change quickly with shifts in liquidity, market structure, or event-driven flows, so ongoing monitoring is key.

Looking Ahead

Market watchers will track whether the premium turns positive, which could signal renewed U.S. spot demand. Real-time readings are available on analytics platforms like CoinGlass.

Conclusion

The continued negative Coinbase Bitcoin Premium since Oct. 29 highlights a period of weaker U.S. spot appetite relative to offshore exchanges. Traders will look for a premium reversal as a potential confirmation of strengthening U.S.-led buying.