Lead

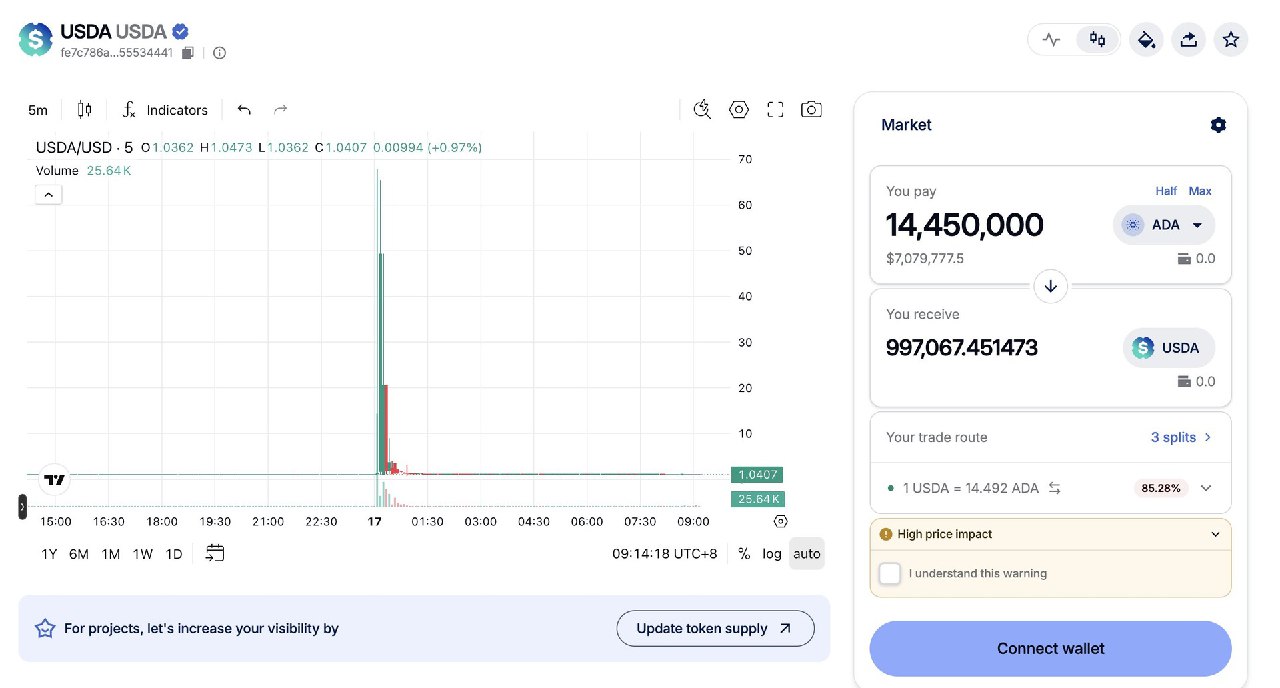

A long-dormant Cardano whale suffered a loss exceeding $6 million after swapping roughly 14.45 million ADA—valued around $6.9–$7.1 million—for just 847,694 USDA, a Cardano-native dollar stablecoin. The trade was executed through a highly illiquid pool, triggering an estimated 85.5% price impact and severe slippage.

Key Developments

- The wallet, inactive for about five years, moved to exchange approximately 14.45M ADA.

- The swap returned 847,694 USDA, implying a loss of roughly $6.0–$6.2 million depending on the ADA/USD valuation at execution.

- On-screen prompts during the swap showed a price impact of ~85.51%, indicating extreme pool illiquidity.

- Charts of the

USDA/USDCpair displayed a temporary spike and sharp reversal, consistent with a large order draining liquidity.

On-Chain Details

- Reported inputs: 14,450,000 ADA.

- Indicative output before execution: approximately 997,067 USDA (warning shown for high impact), while the realized output was 847,694 USDA.

- A snapshot of market data showed

USDA/USDCpricing near 1.0578 during the episode, reflecting volatility amid the liquidity shock.

Market Context

The incident underscores a core DeFi risk: executing large orders in low-liquidity pools can result in catastrophic slippage. Price impact warnings are designed to flag this danger, but when ignored—especially with whale-sized transactions—the results can be disproportionately costly.

Prominent on-chain commentators highlighted the blunder, noting the mismatch between the trade size and available liquidity.

A well-known blockchain investigator publicly mocked the move, labeling the trader “clown of the day.”

Why It Matters

- Highlights the importance of liquidity checks, slippage limits, and order-splitting across venues before executing sizeable swaps.

- Raises questions about the depth and reliability of Cardano-native stablecoin liquidity, including USDA pairs.

- Serves as a cautionary tale for long-term holders re-entering markets via decentralized exchanges without robust execution strategies.

Conclusion

A five-year-dormant Cardano whale’s decision to route a massive ADA sale through an illiquid USDA pool resulted in more than $6 million in losses. The event is a stark reminder: in DeFi, liquidity depth and slippage controls are as critical as asset selection and timing.