Lead

Bitcoin and Ethereum derivatives are showing signs of accelerated position unwinds as futures open interest declines, while Solana registers a sharp increase. A market chart dated November 17, 2025 highlights shifting leverage across majors and notes potential liquidity risks around Bitcoin, alongside observations that open interest’s historical significance may be diminishing.

Key Developments

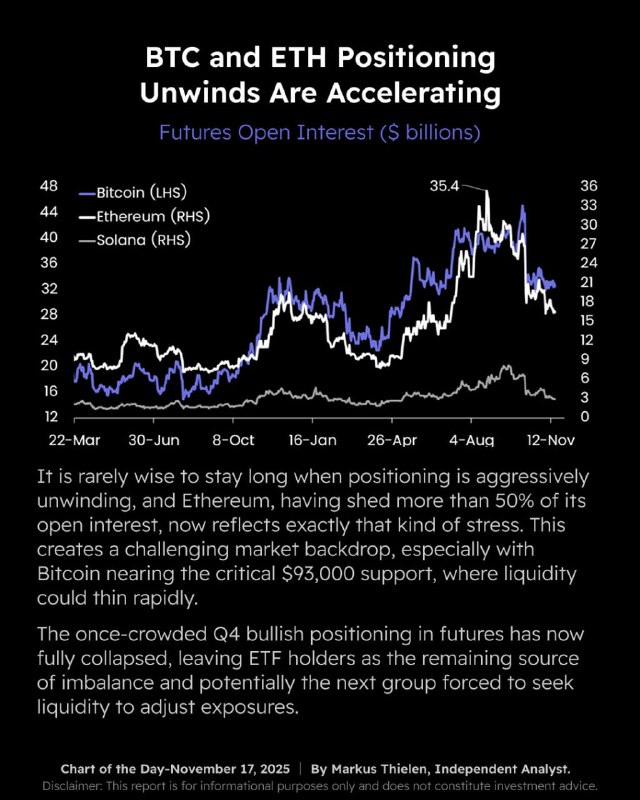

- A historical chart labeled “BTC and ETH Positioning Unwinds Are Accelerating” tracks Futures Open Interest ($ billions) for Bitcoin (LHS), Ethereum (RHS), and Solana (RHS) over December 2022 – November 2023.

- Bitcoin open interest shows a notable decline after peaking around March 2023, indicating a material reduction in leveraged exposure.

- Ethereum and Solana exhibit fluctuating trends with noticeable mid-2023 declines.

- More recently, the chart highlights a steep increase in open interest for Solana, suggesting renewed speculative or hedging activity in SOL futures.

- Commentary on the chart warns about potential liquidity risks around Bitcoin and notes that the historical significance of open interest as a standalone signal is decreasing.

Context and Analysis

Futures open interest (OI) measures the total number of outstanding futures contracts. A decline in OI often reflects position unwinds—traders closing positions and reducing leverage—which can occur after periods of elevated activity or price volatility.

- For Bitcoin, the post-peak drop in OI after March 2023 underscores a meaningful deleveraging phase, which can dampen momentum but also reduce systemic leverage risks.

- Ethereum’s OI volatility through mid-2023 aligns with shifting risk appetite across altcoins during that period.

- The sharp rise in Solana OI suggests growing interest from traders—potentially increasing volatility around SOL if positions become crowded.

The chart commentary cautions that open interest may be a less reliable standalone indicator than in prior cycles and flags liquidity considerations for Bitcoin, implying that rapid shifts in derivatives positioning could strain order books during stress.

Market Impact

- Accelerating unwinds in BTC and ETH futures can lead to lower leverage and potentially quieter derivatives activity, but may also set the stage for sharper moves if fresh positions build quickly.

- The rise in SOL OI could amplify price swings if market sentiment turns or if large positions are forced to unwind.

- Traders may consider monitoring complementary metrics—such as funding rates, basis, and order book depth—to gauge whether changing OI is translating into directional pressure or liquidity stress.

Outlook

With Bitcoin and Ethereum seeing reduced futures exposure and Solana attracting new leverage, derivatives positioning remains a key driver of short-term crypto volatility. Market participants will be watching whether OI dynamics stabilize, and whether liquidity around major assets—particularly Bitcoin—proves resilient during rapid shifts in positioning.