Lead

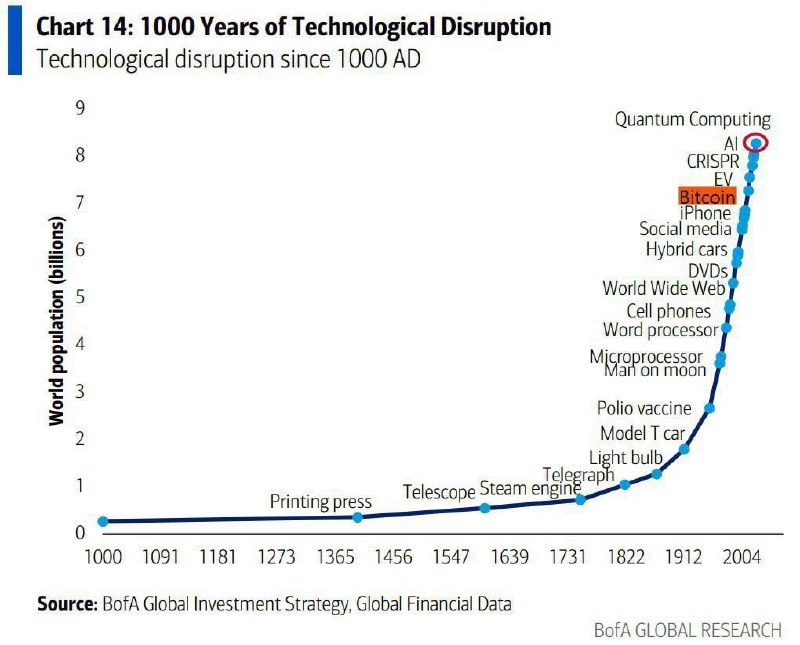

Bank of America’s research unit has featured Bitcoin among the most disruptive innovations of the past millennium in a visualization titled “1000 Years of Technological Disruption.” The chart places Bitcoin alongside landmark breakthroughs such as the printing press, smartphones, electric vehicles (EVs), artificial intelligence (AI), and quantum computing.

Key Developments

- The BofA Global Research chart, labeled “Chart 14: 1000 Years of Technological Disruption,” maps major technological shifts against world population growth.

- The visualization highlights that significant population acceleration began in the 1800s, coinciding with rapid waves of industrial and technological progress.

- Recent entries on the chart include AI and quantum computing, reflecting their anticipated long-term impact on economies and society.

- Bitcoin is positioned among modern innovations, underscoring its perceived potential to transform financial infrastructure and digital value transfer.

Context and Significance

The inclusion of Bitcoin next to historic breakthroughs like the printing press and the smartphone reflects how mainstream financial research increasingly acknowledges the cryptocurrency’s technological and economic relevance. While the chart does not assign rankings, its framework suggests that disruptive innovations can coincide with shifts in productivity, connectivity, and demographic trends.

Bitcoin, launched in 2009 as a decentralized digital currency and settlement network, has evolved into a focal point for debates on monetary systems, payments, and digital assets. Its presence in a long-horizon research chart emphasizes its role not only as an asset but also as a foundational protocol within broader technological change.

Market Impact

Although the chart is analytical rather than market-moving guidance, such recognition from a major research house can shape how institutional investors, policymakers, and corporations frame Bitcoin’s long-term adoption narrative. It also situates Bitcoin within a cluster of technologies—AI, EVs, and quantum computing—that are driving the next wave of digital and industrial transformation.

Conclusion

Bank of America’s visual framework places Bitcoin within a millennium-spanning lineage of disruptive innovation, signaling growing acceptance of its potential structural impact. Market participants will be watching how regulation, infrastructure, and real-world adoption trends evolve as Bitcoin continues to intersect with mainstream finance and technology.