Lead

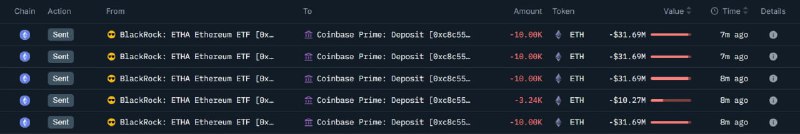

BlackRock transferred 43,240 ETH—valued at approximately $136.7 million—to Coinbase Prime deposit addresses in a series of large on-chain transactions. The transfers, executed in multiple tranches near $33.5 million each, align with activity typically associated with spot Ethereum ETF operations.

Key Developments

- Total moved: 43,240 ETH

- Approximate USD value: $136.7 million

- Destination: Coinbase Prime deposit wallets

- Structure: Multiple tranches, each around $33.5 million

- Wallet labels observed:

BlackRock: ETF(sender) andCoinbase Prime: Deposit(recipient)

The tranche sizing and labeling suggest institutional settlement flows rather than routine exchange deposits. The implied ETH price for the transfers is roughly $3,160 per coin, based on the total value and amount moved.

Why It Matters

Large, labeled transfers from an issuer-affiliated wallet to a custodian such as Coinbase Prime are consistent with ETF share creation or redemption activity. Since the debut of U.S. spot Ethereum ETFs in 2024, issuers periodically move ETH to support primary market operations. While on-chain flows do not confirm net creations by themselves, traders often monitor such movements as a real-time proxy for institutional demand.

Context: Spot Ethereum ETFs and Custody

- BlackRock’s spot Ethereum ETF launched amid broader institutional adoption of crypto products in 2024.

- Coinbase Prime serves as a major institutional venue for custody and settlement tied to ETF issuance and rebalancing.

- Primary market flows for ETFs are later reflected in daily inflow/outflow reports; on-chain movements can precede those disclosures.

For reference on institutional services, see Coinbase Prime. More information about BlackRock can be found at BlackRock.

Market Impact

- Such transfers can indicate incoming ETF creations, which, if confirmed, would represent fresh demand for ETH in the primary market.

- The size and pacing of the tranches are in line with typical institutional settlement practices, aiding execution without disrupting liquidity.

Looking Ahead

Market participants will watch upcoming ETF flow reports and custodian disclosures for confirmation of net creations corresponding to these transfers. If validated, the activity could underscore continued institutional appetite for Ethereum through regulated investment products.